Market News

MCX Gold and Silver retrace towards 21 EMA, Crude Oil faces rejection from ₹5,500; check today’s trade setup

.png)

3 min read | Updated on October 27, 2025, 20:39 IST

SUMMARY

After two weeks of strong gains, bullion prices took a breather, with gold consolidating above ₹1,21,000 and silver slipping around its 21-day EMA. This indicates a short-term pullback within the broader uptrend. Meanwhile, crude oil futures are struggling to break past the ₹5,500 resistance zone.

MCX Crude oil futures pulled back from recent lows of around ₹5,050

Market recap (as of 7:00 pm)

- Gold 5 Dec Futures: ₹1,20,372/ 10 gram (▼ 2.4%)

- Silver 5 Dec Futures: ₹1,41,932/ 1 kg (▼ 3.7%)

- Crude Oil 19 Nov Futures: ₹5,466/ 1 BBL (▲ 0.7%)

Technical view

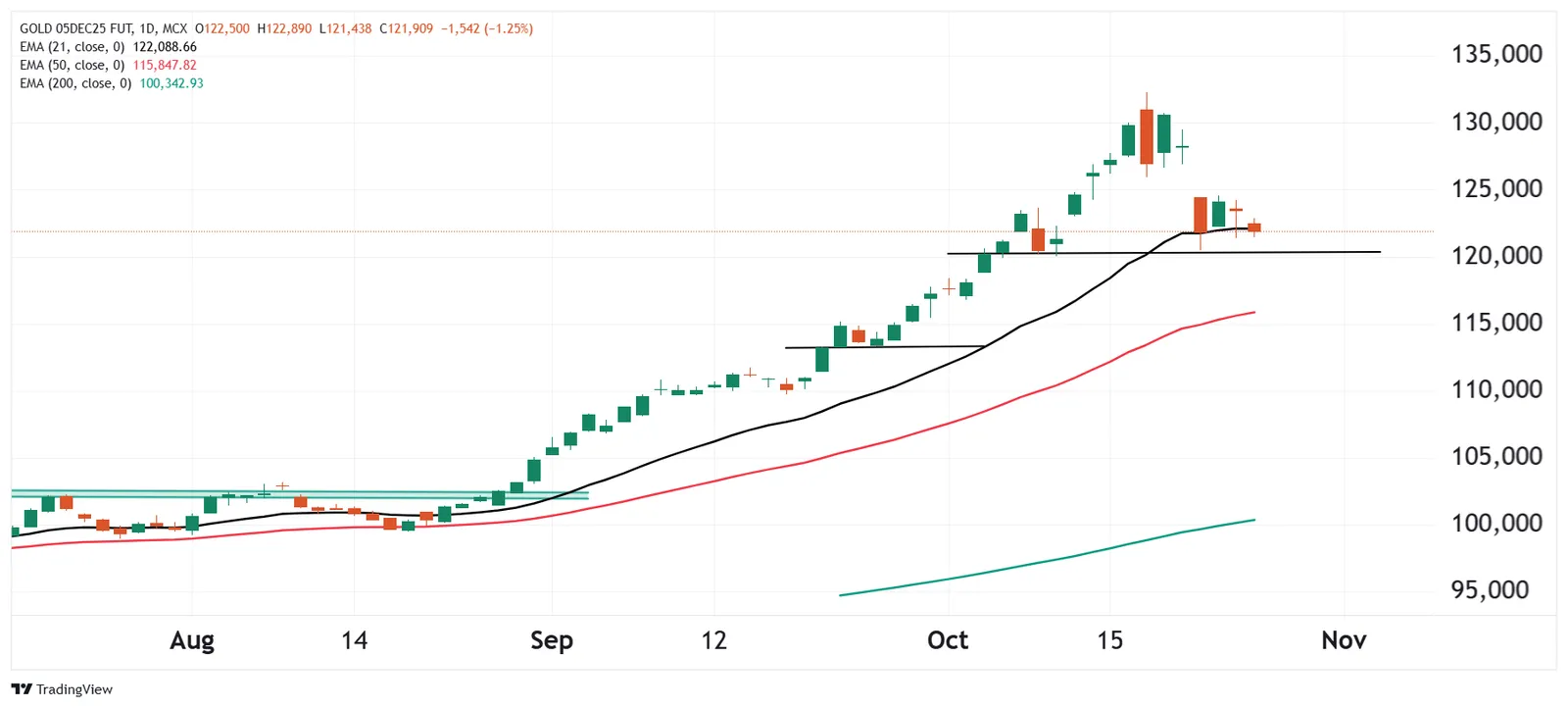

Gold December futures on MCX continued to consolidate following a sharp parabolic rally Short-term momentum has cooled, with prices testing immediate support at around ₹1,21,500–₹1,21,000. This zone also coincides with the 21-day exponential moving average (EMA).

This area has previously acted as a crucial pivot, and remaining above it would suggest that the correction is healthy within the broader uptrend. However, a decisive break below ₹1,21,000 could invite a deeper retracement towards ₹1,17,000–₹1,15,000, which is near the 50-day EMA. On the upside, resistance is found at around ₹1,26,000, and closing above this level could resume the upward trend towards ₹1,30,000.

MCX Silver December futures also extended their pullback following an explosive rally to ₹1,70,000. Having now slipped below the 21-day exponential moving average (EMA) of ₹1,47,700, the metal is signalling a loss of short-term momentum and testing key horizontal support near ₹1,45,000.

If prices remain below this level for an extended period, there is potential for a further decline towards the ₹1,40,000–₹1,38,000 zone, which coincides with the 50-day EMA. Conversely, the ₹1,50,000–₹1,52,000 band is currently providing immediate resistance. Although the broader trend is positive, traders should monitor price stability around the current support level before considering new long positions.

MCX Crude oil futures pulled back from recent lows of around ₹5,050. However, the recovery appears to be losing momentum around the ₹5,400–₹5,450 zone, which is a significant resistance area coinciding with the 21-day and 50-day EMAs. The price is currently struggling to remain above this zone and is forming a bearish reversal candlestick pattern.

If crude oil fails to close decisively above ₹5,450, it could fall back towards the ₹5,250 and ₹5,100 levels in the near term. Conversely, a sustained breakout above ₹5,500 would confirm a trend reversal and pave the way for a potential move towards the ₹5,650–₹5,700 zone.

About The Author

Next Story