Market News

Gold prices hit two-week low, fall below ₹1 lakh per 10 gram: Here’s why gold rates are declining

5 min read | Updated on August 22, 2025, 14:04 IST

SUMMARY

Gold prices in India have slipped below the ₹1 lakh mark and are trading near their two-week low, driven by ease in geopolitical tensions, extension of tariff truce between the US and China, and anticipation around Fed policy signals from Jackson Hole.

24k gold prices fell from ₹1.02 lakh to ₹99,410 per 10 gram, dropping by over 2.6% in last two-weeks

Gold price in India has witnessed a pullback in recent weeks, with 24k gold price slipping below the ₹1 lakh mark after touching record highs earlier this year. As of Aug 21, 2025, gold prices settled at 99,410 per 10 gram, marking a drop of over 2.6% in the past 2 weeks. Market remains forward-looking on to geopolitical developments concerning Ukraine and the Jackson Hole Symposium. Many investors are now seizing the opportunity to lock in profits, contributing to a further decline in gold prices in domestic markets.

| Date | Gold Price (₹/10 gram) | % Change |

|---|---|---|

| Aug 21, 2025 | 99,470 | -0.10% |

| Aug 20, 2025 | 99,510 | -0.10 |

| Aug 19, 2025 | 99,530 | -0.02 |

| Aug 18, 2025 | 99,650 | -0.12 |

| Aug 17, 2025 | 1,00,390 | -0.74 |

| Aug 16, 2025 | 1,00,380 | 0.01 |

| Aug 15, 2025 | 1,00,370 | 0.01 |

| Aug 14, 2025 | 1,00,360 | 0.01 |

| Aug 13, 2025 | 1,00,420 | -0.06 |

| Aug 12, 2025 | 1,00,250 | 0.17 |

| Aug 11, 2025 | 1,00,540 | -0.29 |

| Aug 10, 2025 | 1,02,090 | -1.52 |

| Total | ▼ 2.6% |

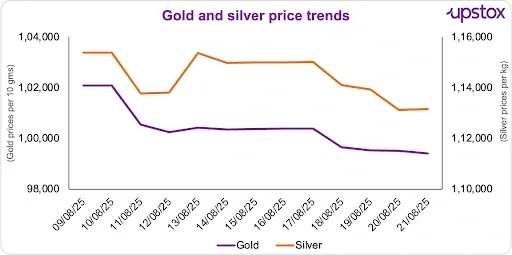

The percentage dip over the last two weeks, where 24k gold prices fell from ₹1,02,090 to ₹99,410 per 10 gram, dropping by over 2.6% indicating a correction phase. A similar movement was observed in MCX Gold Futures, which has declined around 3% in the same period. The correction in gold and silver prices is mirroring macro events beyond India, with silver prices dropping from ₹1.15 lakh per kg to ₹1.12 lakh, a decrease of 2%.

Fall in safe haven demand

Historically, gold thrives on uncertainty and rises sharply when investors fear turmoil. Recent ease in geopolitical tension, such as reduced intensity in the Russia-Ukraine conflict, improved US-Europe relations, stabilisation of global supply chains, etc, made investors less attracted to safe haven assets like Gold. Investors view it as an investment expected to retain or even increase its value during market turbulence. When geopolitical tension eases, we tend to see a risk-averse nature in investors. A shift in their capital allocation, with investors investing in riskier assets like equities and bonds, rather than putting their money in safe assets like gold. This shift has contributed to the recent drop in gold prices.

Ease in the US-China tariff war

The US and China have pressed pause on their tariff battle, extending their truce by another 90 days. The tariff in China could have spiked to 145% with China’s duties on US exports to 125%. But with this short-term relief and a current rate of around 30% for US tariffs on Chinese goods and 10% for China’s on US goods, there is some certainty in the market. The truce, effective until November 10, 2025, provides markets with temporary stability. With reduced likelihood of new tariffs or trade disruptions, the need for gold as a global hedge diminished substantially. With falling concerns over trade barriers, which could disrupt the global economic growth, it directly relates to diminishing gold’s attractiveness as a protective investment for investors.

Focus on Jackson Hole Symposium

A global event, the Jackson Hole Symposium is set to happen where central bank leaders, including the Federal Reserve, unveil their visions for the future of monetary policy. Investors are looking forward to cues on interest rates, inflation, labour policy, etc, which heavily influence the gold prices. Markets are expecting a 25 bps rate cut by the US Federal Reserve amid the risk of an economic slowdown in the US. However, consensus is shifting toward a “wait and see” approach, easing the immediate rise in gold prices, adding to the recent correction in prices.

Market speculation and profit booking

Gold prices saw a strong rally earlier in 2025, but many investors are likely to have reverted to profit booking amid uncertainty and price volatility. For example, MCX Gold October futures rose by about ₹2,430 per 10 grams in early August 2025, but declined in the latter half of the month. Gold prices pulled back from record highs, showing the impact of this selling pressure.

The speculative nature of these sales amplified downward price pressure when many investors sell to lock in profits. Gold breached multiple psychological levels this year, even exceeding ₹1 lakh per 10 gram in India. Such dramatic gains may have prompted profit booking by large institutional and retail investors, adding downward pressure.

Before you go

The recent decline in gold prices is not an isolated event but a reflection of shifting global dynamics. This shows how sensitive gold is to significant economic events and changes in market mood. Gold remains an important long-term hedge, but its price in the short term will continue to react to changes in policy and market sentiment.

About The Author

Next Story