Market News

Commodities trade setup: Gold and silver rebound, oil prices range-bound

.png)

3 min read | Updated on October 24, 2024, 19:00 IST

SUMMARY

Gold prices opened on a positive note on Thursday at ₹76,302/10 gm and are currently trading within the previous day's range. Meanwhile, Silver also opened in green at ₹97,451/kg and is also consolidating within the previous day's range.

Commodities trade setup: Gold and silver rebound, oil prices range-bound

Market recap:

Gold 5 Dec Futures: ₹78,465/ 10 gram (▲0.8%) Silver 5 Dec Futures: ₹98,408/ 1 kg (▲1.4%) Crude Oil 19 Nov Futures: ₹6,002/ 100BBL (▲0.4%) (As of 6:40 pm)

Gold: The yellow metal rebounded after a one-day pause, gaining 0.8% to $2,737 an ounce on the spot market. Uncertainty surrounding the U.S. election, which is less than two weeks away, and ongoing geopolitical tensions between Israel and Iran prompted investors to seek out the safe-haven asset.

Silver: Silver prices continued their upward trajectory, crossing the $34.50 an ounce mark to hit a 12-year high. This follows last week's strong rally of almost 7%. Demand for safe-haven assets has been boosted by uncertainty over the outcome of the U.S. election and interest rate cuts.

Crude oil: Crude oil prices rose nearly 1% on Thursday as conflict in the Middle East and reports of North Korean troops helping Russia in Ukraine kept traders on edge ahead of the U.S. presidential election. The Brent Crude Futures rose 0.7% to $75 per barrel, while West Texas Intermediate (WTI) futures advanced 0.6% to $72 a barrel.

Technical structure

Gold: Prices of 5 December’s Futures contract is currently consolidating between ₹77,900 and ₹78,400. However, the broader trend remains bullish until it slips below the immediate support of ₹77,900. As per the one hour time frame, the gold prices are trading above VWAP and a close above ₹78,400 can lead to further bullishness.

Silver: Silver has cooled down marginally after touching the ₹1,00,000 mark on Wednesday. However, the 5 December Futures have been trading firmly in the green since this morning and above key resistance levels. As seen in the one-hour chart below, the price of 1 kg silver on MCX is currently holding the immediate support level of ₹97,100, but is below the VWAP. Meanwhile, the broader trend remains bullish and the price is currently consolidating at higher levels after a sharp rise. A break above ₹1,00,080 will provide traders fresh directional clues.

Crude oil: Crude oil is currently consolidating between the wide range of ₹6,150 and ₹5,700 as seen on the hourly chart of the November 19 contract. Unless it breaks through the resistance and support levels highlighted on the chart below, the trend may remain range-bound. Traders can plan directional strategies on the break of this range.

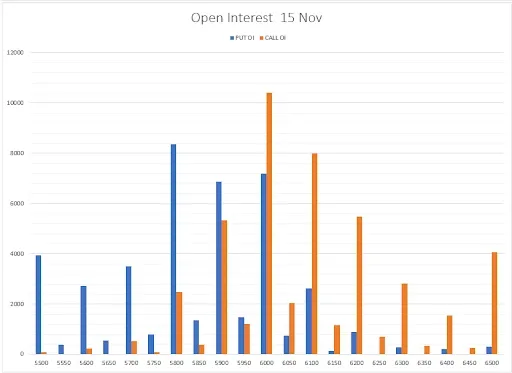

Options overview crude oil

Expiry: 15 November

The open interest data of the 15 November expiry has the highest put base at 5,800 strike price, indicating support for crude oil futures in this zone. On the flip side, the call base was seen at 6,000 and 6,100 strike price, suggesting resistance around these levels for crude oil.

Disclaimer:

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for the client's consumption, and such material should not be redistributed. We do not recommend any particular stock, securities, or strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely to show how to do analysis. Take your own decision before investing.

About The Author

Next Story