Business News

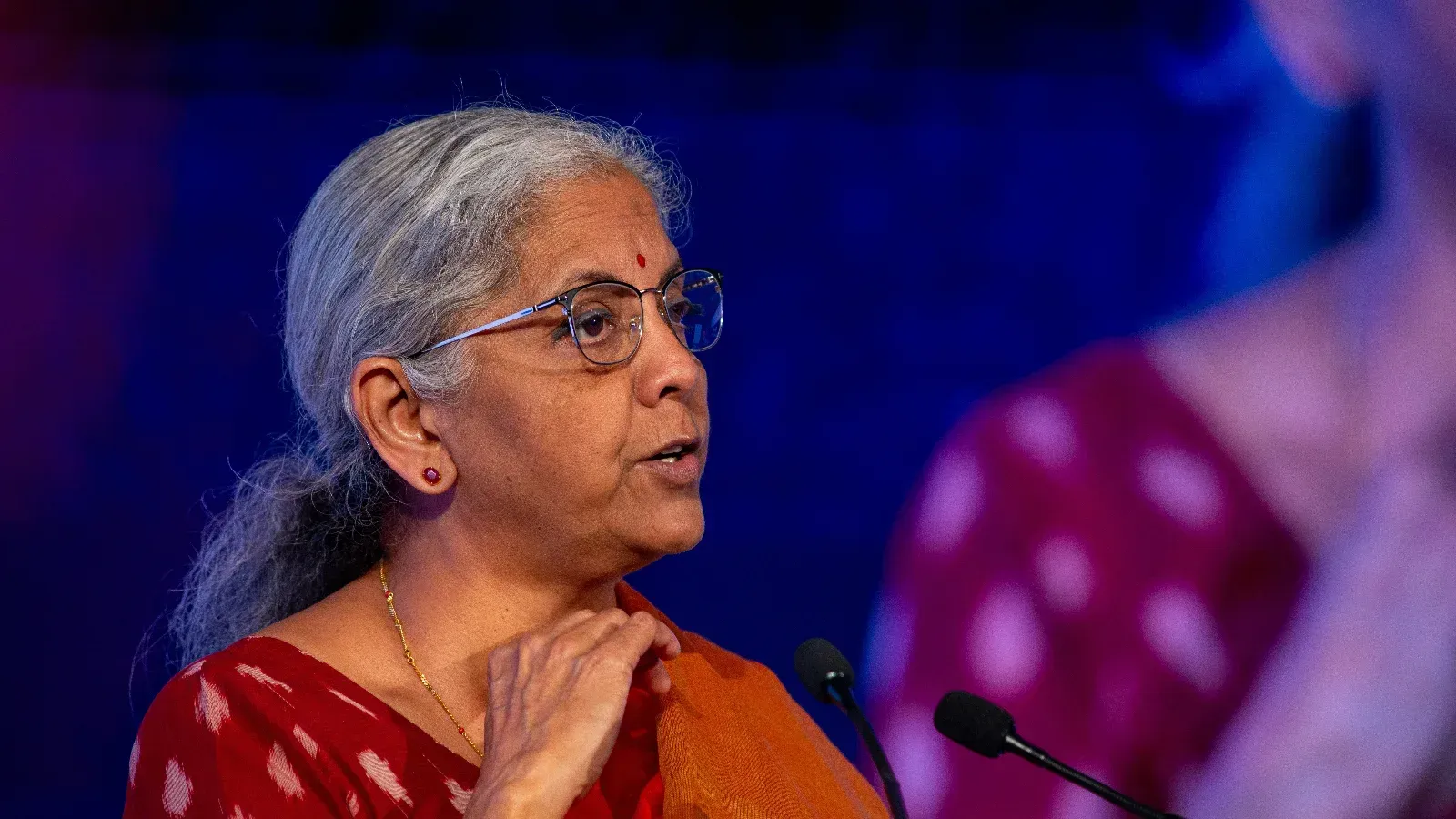

Why India’s biggest banks could soon get even bigger; FM Sitharaman drops hint

.png)

3 min read | Updated on November 07, 2025, 11:22 IST

SUMMARY

Finance Minister Nirmala Sitharaman signalled a possible new phase of banking sector consolidation and restructuring, saying the government is working with the Reserve Bank of India (RBI) and lenders to create “big and world-class banks.”

Finance Minister Nirmala Sitharaman said the bank nationalisation done in 1969 has not yielded the desired result as far as financial inclusion was concerned.

Finance Minister Nirmala Sitharaman on Thursday said the government is working with the central bank and lenders to explore ways to build “big and world-class banks”, indicating that a fresh round of consolidation or restructuring could be on the cards for the country’s banking sector.

Addressing the 12th SBI Banking and Economics Conclave 2025, Sitharaman said discussions were underway with the Reserve Bank of India (RBI) and banks to determine the roadmap for expanding India’s financial sector and strengthening its global competitiveness.

“The government is looking at this and work has already commenced. We are discussing with the RBI. We are discussing with banks,” Sitharaman said.

"It is not by creating from those which exist today...just by amalgamation that can also be one of the routes, but you need an ecosystem and an environment in which more banks can operate and operate to grow. So, that environment is actually well established in India, but I needed to be more dynamic. So, some work is happening on it," she said.

Her comments suggest the government may be considering a new push to scale up Indian lenders, similar to earlier consolidation drives that reduced the number of state-run banks from 27 in 2017 to 12 by 2020 through a series of mergers.

United Bank of India and Oriental Bank of Commerce were merged with Punjab National Bank, Syndicate Bank with Canara Bank, Allahabad Bank with Indian Bank, and Andhra Bank and Corporation Bank with Union Bank of India.

In 2019, Dena Bank and Vijaya Bank were merged with Bank of Baroda, while the country’s biggest lender, State Bank of India, absorbed five of its associate banks and Bharatiya Mahila Bank in 2017.

Besides, as part of the privatisation exercise, the government in January 2019 sold its controlling 51% stake in IDBI Bank to Life Insurance Corporation of India (LIC).

Subsequently, the government and LIC announced plans for the strategic sale of their stake in IDBI Bank.

In October 2022, both shareholders had invited EoI (Expression of Interest) from investors for privatising IDBI Bank by selling a total of 60.72% stake. This includes a 30.48% stake of the government and 30.24% of LIC.

In January 2023, the Department of Investment and Public Asset Management (DIPAM) received multiple EoIs for IDBI Bank.

Paving the way for the sale of IDBI Bank, SEBI in August 2025 has approved the reclassification of Life Insurance Corporation as a public shareholder from promoter of the bank on completion of strategic divestment in the lender.

Privatisation drive next?

Sitharaman, at the Diamond Jubilee Valedictory Lecture of the Delhi School of Economics earlier this week, said that the 1969 bank nationalisation had “not yielded the desired results” in terms of financial inclusion, triggering speculations of a privatisation drive.

While acknowledging that nationalisation helped push priority sector lending and government programmes, the finance minister argued that government control made PSBs “unprofessional”.

“After we professionalised the banks, those objectives are still being beautifully achieved,” she said, adding that fears of losing inclusion objectives through privatisation were “incorrect.”

Sitharaman said misuse of PSBs in the past led to balance sheet stress and the “twin balance sheet problem” seen in 2012–13.

It took nearly six years under the Modi government to repair the system, she noted, adding that Indian banks now stand out globally in terms of asset quality, credit growth and financial inclusion.

Her comments drew sharp rebuttal from bank unions and civil society groups, which cautioned the government against privatising public sector banks (PSBs).

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story