Business News

Which Indian export sectors will be hit hardest by 50% US tariff?

.png)

3 min read | Updated on August 07, 2025, 14:11 IST

SUMMARY

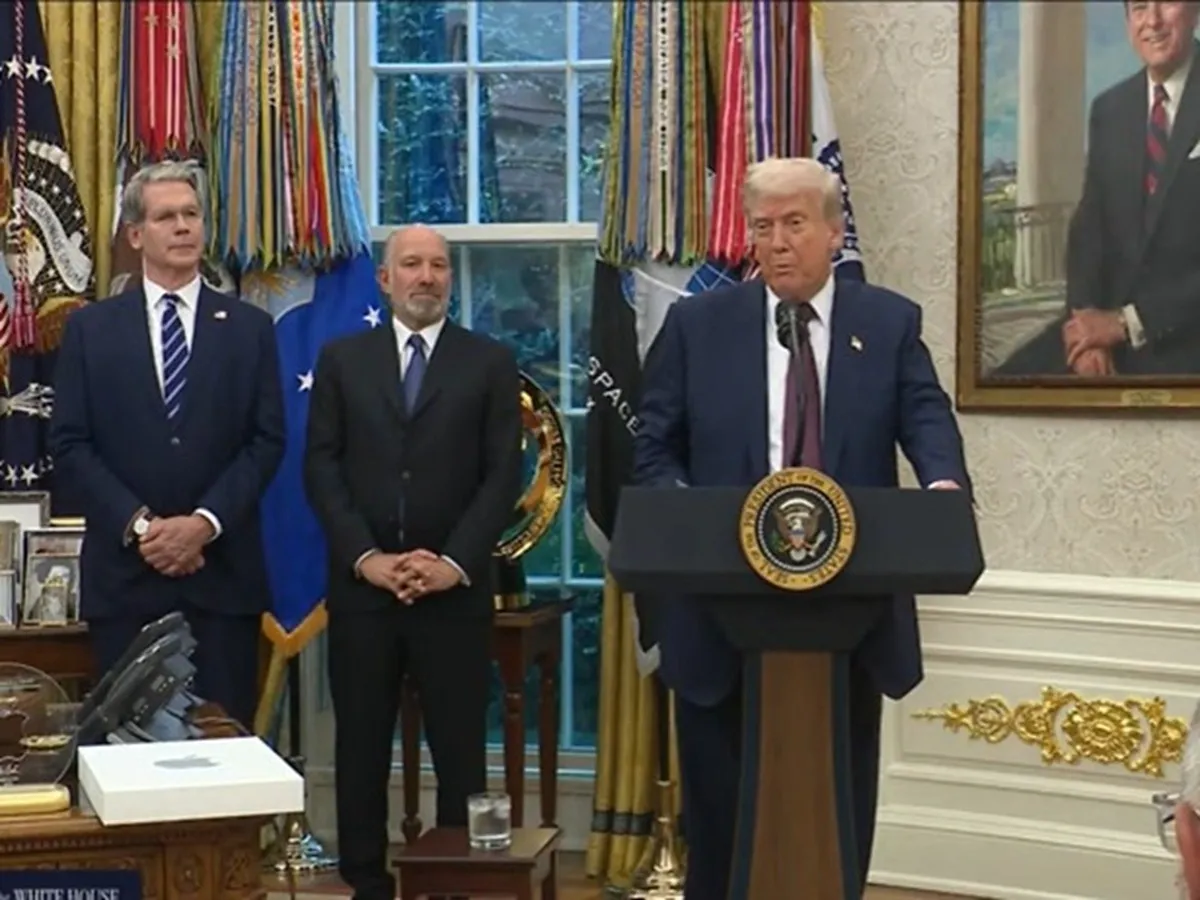

The tariff, announced by President Donald Trump as a penalty for India's continued purchase of Russian oil, raises concerns among Indian exporters about competitiveness and potential loss of US market share.

The United States has imposed additional tariffs or penalty for Russian imports only on India while other buyers such as China and Turkey, have so far escaped such measures.

A new 25% US tariff on Indian goods, announced by President Donald Trump on Wednesday, is set to severely impact key Indian export sectors, including textiles, gems and jewellery, shrimp, leather, footwear, and chemicals, industry experts warned.

The tariff hike, which raises the existing 25% duty to 50% effective August 27, comes as a penalty for India’s continued purchase of Russian oil.

Trump signed an executive order titled "Addressing Threats to the US by the Government of the Russian Federation," imposing the additional levy on most Indian goods, barring a small exemption list.

The Global Trade Research Initiative (GTRI) estimated the tariffs could slash India’s US-bound exports by 40-50%, making Indian products significantly costlier.

Sectors facing steep duties:

-

Organic chemicals (54%)

-

Carpets (52.9%)

-

Knitted apparel (63.9%)

-

Woven apparel (60.3%)

-

Textiles (59%)

-

Diamonds and gold products (52.1%)

-

Machinery (51.3%),

-

Furniture (52.3%)

In 2024-25, US-India bilateral trade reached $131.8 billion, with India exporting $86.5 billion worth of goods, including textiles and clothing ($10.3 billion), gems and jewellery ($12 billion), shrimp ($2.24 billion), leather and footwear ($1.18 billion), chemicals ($2.34 billion), and machinery ($9 billion).

Yogesh Gupta, managing director of Kolkata-based seafood exporter Megaa Moda, said the tariffs would make Indian shrimp uncompetitive, noting that the sector already faces a 2.49% anti-dumping duty and a 5.77% countervailing duty.

"We are already facing huge competition from Ecuador as it has only 15% tariff. Indian shrimp already attracts a 2.49% anti-dumping duty and a 5.77% countervailing duty. After this 25%, the duty will be 33.26%," Gupta said.

The Confederation of Indian Textile Industry (CITI) expressed deep concern, calling the tariff a “huge setback” for India’s textile and apparel exporters, who rely on the US as their largest market.

"It has further complicated the challenging situation we were already grappling with and will significantly weaken our ability to compete effectively vis-à-vis many other countries for a larger share of the US market," it said.

Colin Shah, managing director of Kama Jewelry, described the tariff as a “severe setback,” affecting 55% of India’s US exports. He warned that the 30-35% competitive disadvantage compared to countries with lower tariffs could force exporters, particularly small and medium enterprises, to lose clients as buyers reassess sourcing due to higher costs.

The negotiations between India and the US are still going on for an interim trade deal, however, any compromise on the red lines with regard to duty concessions on agriculture items, dairy, and genetically modified (GM) products is unlikely.

The two countries are negotiating a bilateral trade agreement (BTA). They are aiming to conclude the first phase of the pact by fall (October-November) this year.

Exporters are hoping that early finalisation of the India-US bilateral trade agreement will help in dealing with the tariff challenges.

Related News

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story