Business News

Union Budget 2026 process: From speech to implementation, everything you need to know

.png)

3 min read | Updated on January 21, 2026, 13:21 IST

SUMMARY

After the Budget speech, Parliament undertakes a multi-step process, including a general discussion in both Houses, before proposals become law.

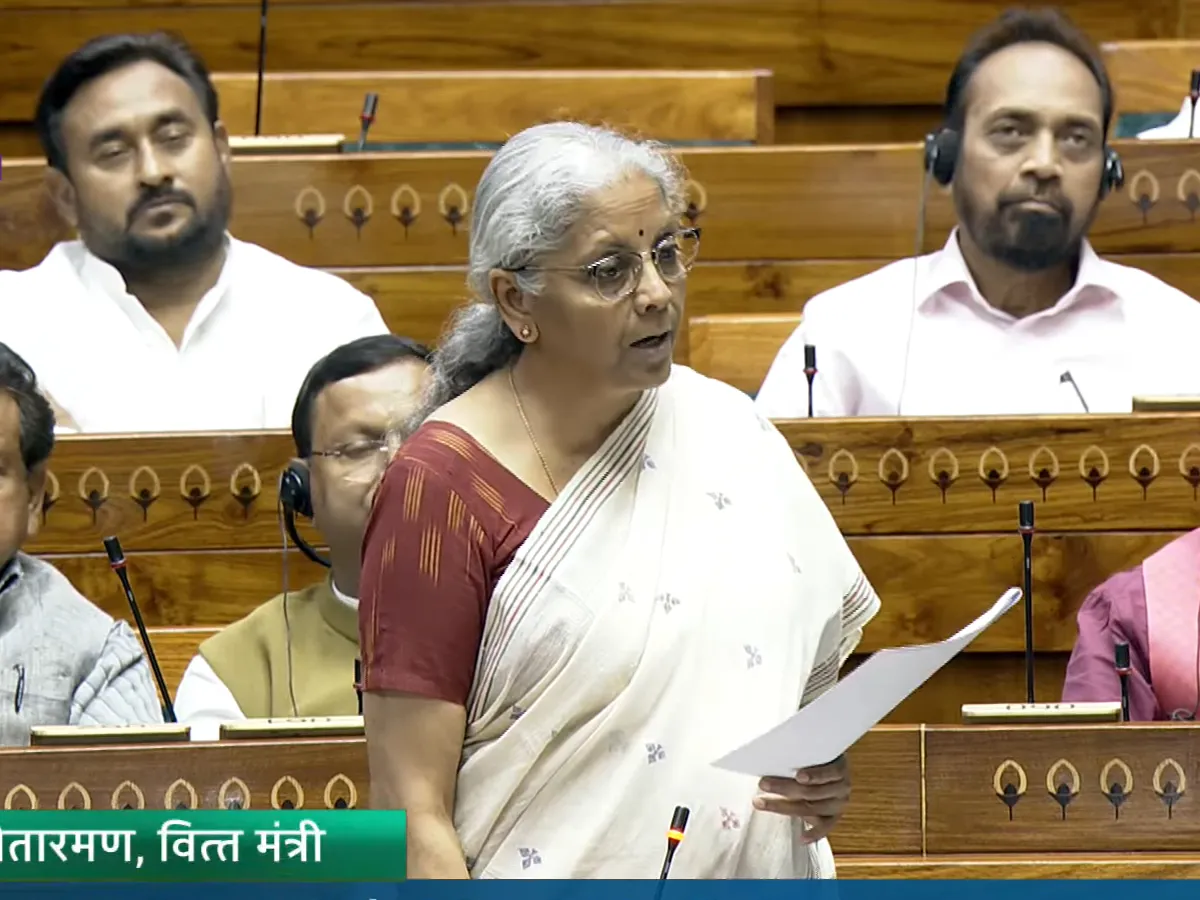

Finance Minister Nirmala Sitharaman will present the Union Budget 2026–27 on February 1, her ninth consecutive Budget. (Sansad TV)

Finance Minister Nirmala Sitharaman will present the Union Budget 2026-27 on February 1, marking her ninth consecutive Budget since taking charge in May 2019.

While the Budget presentation draws maximum attention, a detailed parliamentary process unfolds after the Budget speech before proposals translate into spending and tax changes.

Here is a step-by-step look at what follows the Budget presentation.

General discussion in Parliament

After the Budget is presented, a general discussion is held in both Lok Sabha and Rajya Sabha.

Members, at this stage, debate the overall economic policy and fiscal strategy.

The discussion does not go into ministry-wise details, nor is there any voting.

The finance minister responds to the debate at the end.

If the full Budget cannot be approved before the start of the new financial year, the government seeks a Vote on Account, which allows it to meet essential expenditure for a limited period.

After the general discussion, Parliament may go into recess for a few weeks.

The first phase of the 2026 Budget session will conclude on February 13, before the Parliament reassembles again on March 9.

During this recess, detailed estimates of expenditure of all ministries, called Demands for Grants, are sent for examination to the Parliamentary Standing Committees.

At present, 24 Standing Committees, comprising members from both Houses, oversee different ministries.

The committees examine the proposed allocations in detail, question officials and submit reports to Parliament.

Their reports help MPs understand the implications of proposed spending and form the basis for further discussion in the Parliament.

Voting on Demands for Grants

When Parliament reconvenes, the Lok Sabha takes up voting on Demands for Grants for individual ministries. Only the Lok Sabha has the authority to approve or reject expenditure demands.

Detailed debates are usually held for four or five ministries, chosen by the Lok Sabha’s Business Advisory Committee.

The remaining Demands for Grants that are not discussed by the final day are put to vote together, a process known as “guillotine”.

Appropriation Bill

Once the Demands for Grants are passed, they are consolidated into the Appropriation Bill. This Bill authorises the government to withdraw money from the Consolidated Fund of India, which includes all government receipts and borrowings.

Finance Bill gives effect to tax changes

The Finance Bill, which contains the government’s tax proposals, is taken up for consideration and passage. The Finance Bill is usually a Money Bill, which means it requires approval only from the Lok Sabha. The Rajya Sabha can make recommendations but cannot amend or reject it.

Supplementary Demands during the year

If the government needs to incur expenditure not approved in the Budget, it can seek Parliament’s approval through Supplementary Demands for Grants. These are usually presented and passed in every Parliament session.

Unlike the main Demands for Grants, supplementary demands are not examined by Standing Committees.

Related News

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story