Business News

Union Budget: A paradigm shift in defence spending towards modernisation and indigenisation

.png)

7 min read | Updated on June 21, 2024, 17:33 IST

SUMMARY

India’s defence budget is one of the largest in the world. In the past few years the budget has emphasized themes like Atmanirbhar Bharat ( self-reliance), Modernisation of armed forces, encouragement of export, focus on capital outlay and infrastructure development while keeping in mind emerging security threats.

.webp)

Shift in Defence budget’s paradigm to modernisation and indigenisation

The changing geopolitical dynamics and India's sensitive geographical location make the nation vulnerable to security threats. This underscores the urgent need to modernize the defence sector and achieve self-sufficiency. However, do the ambitious budget allocations truly reflect this policy intent?

Let’s delve into the actual capital outlay in the budgetary allocation for defence, the export performance of the defence sector, and the recent performance of Nifty Defence stocks.

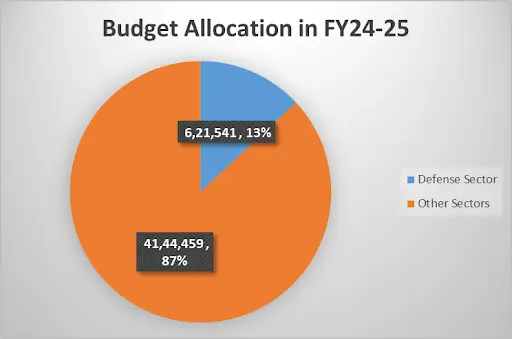

Budgetary Allocation to the Defence sector

India stands 4th in the rankings of highest defence spending countries next only to the US, China and Russia. The Defence share in budget allocation in the interim budget for FY 24-25 stood at 13% at ₹6.21 lakh crore out of a total budget of ₹47.66 lakh crore.

The focus of India’s budget allocation to defence has been modernisation and procurement, Indigenization, Improving infrastructures and promoting R&D including modern warfare like Cyber and Space wars.

(Source- Union Budget)

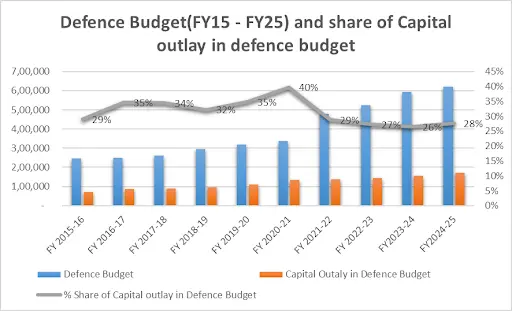

(Source- Union Budget)It is to be noted that budgetary allocations do not provide a clear picture of the actual financial outlay assigned towards the capability enhancement programme during the financial year. The Capital Outlay on Defence Services includes the modernisation budget for the three services. Therefore analysis of capital outlay in budgetary allocation is important to determine the effect of budgetary spending on defense sector industries.

Below chart depicts the share of capital outlay in the defence budget during the period of FY 15 to FY 25

(Source -Manohar Parrikar Institute for Defense Studies and Analysis)

(Source -Manohar Parrikar Institute for Defense Studies and Analysis)| Budget Estimates | Defence Budget | Capital Outlay in Defence Budget |

|---|---|---|

| FY 2015-16 | 2,46,727 | 71,675 |

| FY 2016-17 | 2,49,099 | 86,357 |

| FY 2017-18 | 2,62,389 | 90,438 |

| FY 2018-19 | 2,95,511 | 95,231 |

| FY 2019-20 | 3,18,931 | 1,11,092 |

| FY 2020-21 | 3,37,553 | 1,34,305 |

| FY 2021-22 | 4,78,196 | 1,37,987 |

| FY 2022-23 | 5,25,100 | 1,42,940 |

| FY 2023-24 | 5,93,500 | 1,57,228 |

| FY 2024-25 | 6,21,541 | 1,72,000 |

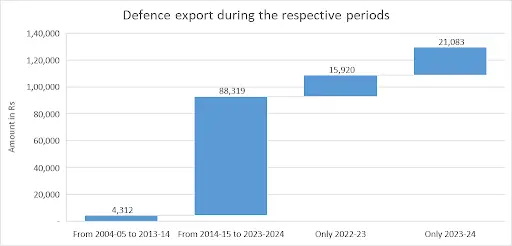

Defence Export

The Defence Industry, including the private sector and Defence Public Sector Undertakings (DPSUs), have made tremendous efforts to achieve the highest-ever defence exports. The private sector and the DPSUs have contributed about 60% and 40% respectively.

A comparative data of two decades i.e. the period from 2004-05 to 2013-14 and 2014-15 to 2023-24 reveals that there has been a growth of 21 times in the defence exports.

Below chart depicts defense export in respective periods

(Source - Pib.gov.in)

(Source - Pib.gov.in)

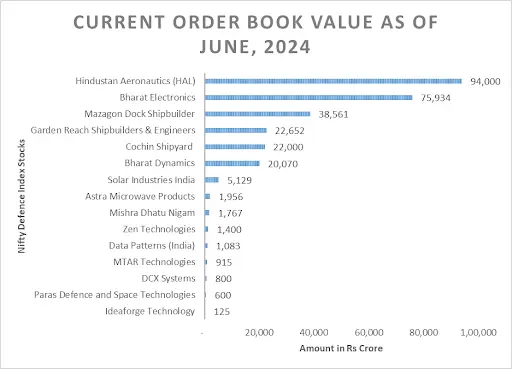

Below table summarizes the order book value and last one year's return of Top Nifty Defence Index stocks as of June 19, 2024 (Amount in ₹)

| Nifty Defense Index | Current Order Book Value | Last 1 years return |

|---|---|---|

| Hindustan Aeronautics (HAL) | 94,000 | 176.76% |

| Bharat Electronics | 75,934 | 149.14% |

| Mazagon Dock Shipbuilder | 38,561 | 229.36% |

| Garden Reach Shipbuilders & Engineers | 22,652 | 199.88% |

Last week the company received a request for a proposal from the Ministry of Defence for 156 light combat helicopters worth ₹45,000 crore.

In the last 5 years, the compounded sales and profit growth have been 11% and 16% respectively, while stock price has grown at a compounded annual growth rate (CAGR) of 53%. FY 24 financial performance of the company has been best with consolidated net profit at ₹3,985 crore and consolidated revenue at ₹20,268 crore.

In the last 3 years, the stock has grown at a CAGR of 150%, while sales and profits have compounded at 15% and 29%, respectively.

The company’s compounded sales and profit growth for the last 5 years have been 21% and 26% respectively. The stock price has grown at a CAGR of 72% in the last 5 years.

Below table summarizes the order book value and last 1 year return of other Nifty Defence Index stocks as of June 19, 2024 (Amount in ₹)

| Nifty Defense Index | Current Order Book Value | Last 1 years return |

|---|---|---|

| Cochin Shipyard | 22,000 | 664.99% |

| Bharat Dynamics | 20,070 | 162.76% |

| Solar Industries India | 5,129 | 157.38% |

| Astra Microwave Products | 1,956 | 177.68% |

| Mishra Dhatu Nigam | 1,767 | 62.77% |

| Zen Technologies | 1,400 | 191.95% |

| Data Patterns (India) | 1,083 | 57.02% |

| MTAR Technologies | 915 | -3.65% |

| DCX Systems | 800 | 26.84% |

| Paras Defence and Space Technologies | 600 | 128.79% |

| Ideaforge Technology | 125 | *- |

Expectations from upcoming budgets

The Agenda set by Defence Minister after assuming charge for 2nd term of an ambitious target to export over ₹50,000 crore worth of defence equipment by 2028-29 and the pattern observed in the interim budget the full-fledged budget in July 2024 would continue to focus on the following-

- Modernisation of armed forces and indigenisation of defence procurements

- Investment in border infrastructure for Strengthening Border Infrastructure for strategic requirements

- Continuing with Atmanirbhar and Make in India initiatives

- Strengthening the Indian Navy and Coast Guard capabilities.

- Promotion of innovation and self-reliance in defence research and development through DRDO

Conclusion

The bumper returns by other defence stocks like Cochin Shipyard, Bharat Dynamics, Solar Industries India, Astra Microwaves Products, Zen Technologies and Paras Defence last year would keep defence stock in focus. The current total order book of the Nifty Defence Index stands at ₹2.87 lakh crore paving the way for future potential.

The interim budget estimates for the Ministry of Defence are largely in line with the broad trends of the past decade in terms of revenue and capital allocations. The government’s focus on research and development is evident in the announcement of the new Rs 100,000 crore corpus while the combined budget heads for modernisation under the Capital Outlay on Defence Services do indicate a focus on integrated defence planning process from the budgetary perspective as well, if the trend continues going forward. The announcement of a new scheme to strengthen deep technologies (deep-tech) for defence purposes would further aim to expedite ‘atmanirbharta’ (self-reliance).

While the interim budget provides a preview of India’s ongoing defence priorities and showcases a consistent approach in implementing policy initiatives towards the modernisation of the armed forces and promoting a domestic ecosystem for defence manufacturing, the final budgetary picture will be provided by the full budget of FY 24-25 expected in June-July 2024

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story