Business News

RBI Governor on US tariffs: Hopeful of amicable solution, prepared to take required measures

.png)

3 min read | Updated on August 06, 2025, 12:55 IST

SUMMARY

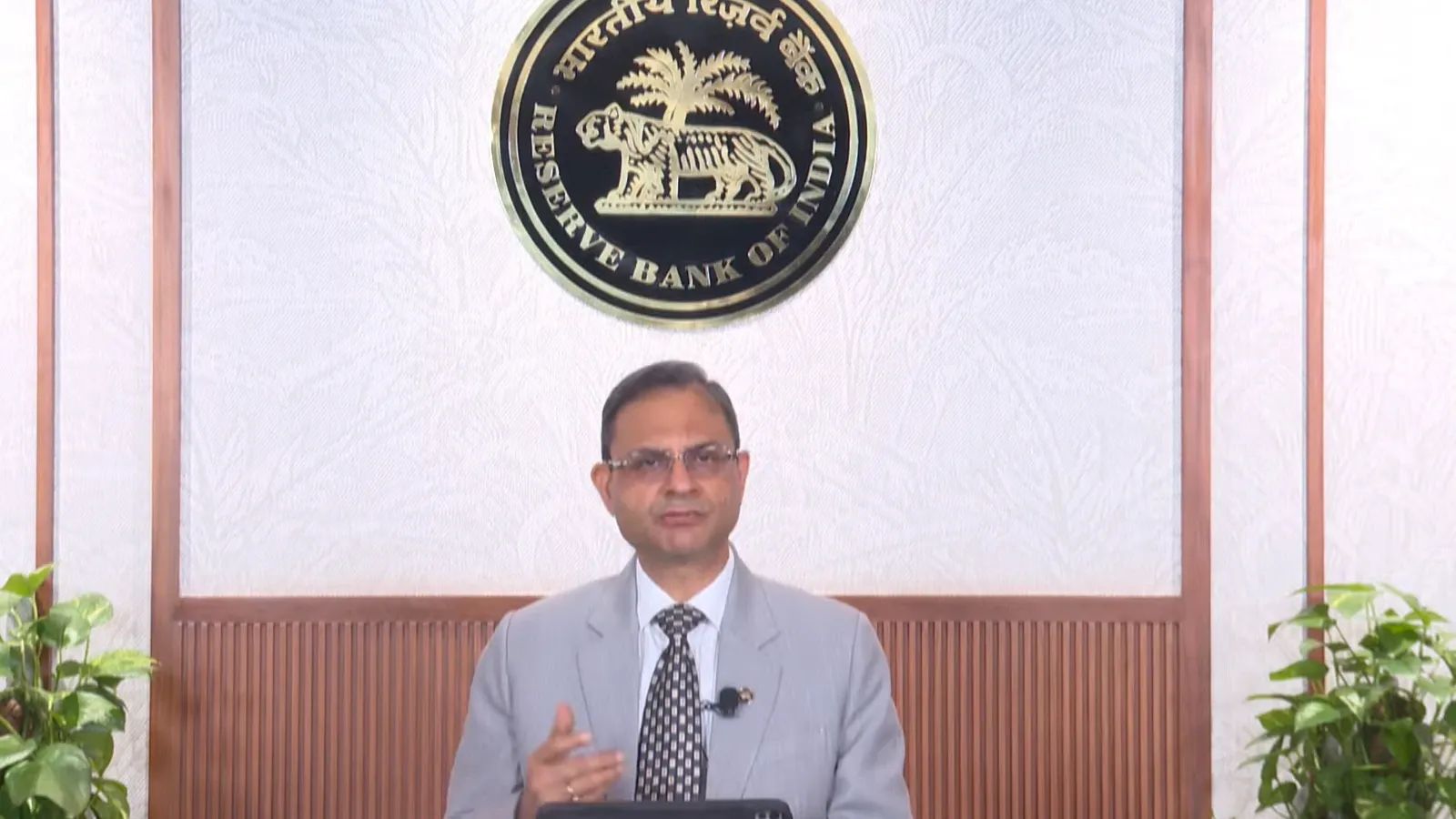

RBI Governor Sanjay Malhotra was responding to a question on whether the central bank was prepared to take any action to shield Indian businesses from the impact of the escalating tariff tensions with the US.

The Reserve Bank kept the repo rate unchanged at 5.5% in its August MPC meet.

Amid mounting concerns over the economic fallout from the latest tariff actions by the United States, Reserve Bank of India (RBI) Governor Sanjay Malhotra on Wednesday said the central bank remains hopeful for an amicable solution from the ongoing trade negotiations.

Responding to a question on whether the central bank could take any action to shield Indian businesses from the impact of the escalating tariff tensions with the US, Governor Malhotra emphasised that the RBI had already deployed a range of tools and was prepared to do more as needed.

“We have taken a number of measures to support the growth. It's not only on the monetary policy, liquidity side, even you know on the prudential regulation side, we have taken measures,” Malhotra said.

“Even you know on the FEMA [Foreign Exchange Management Act] side, we have a draft now which will be put up so as to ease doing business and international trade, and we will continue to do whatever is required to be done in such a scenario.”

His comments come in the wake of US President Donald Trump’s announcement of a 25% tariff on Indian goods. Trump accused India of maintaining "the most strenuous and obnoxious non-monetary Trade Barriers of any Country" and warned of additional penalties related to India’s continued energy and defence trade with Russia.

The unexpected escalation has sparked concerns across business and policy circles in India, with many economists noting that monetary easing alone may be insufficient to counter the complex geopolitical and trade-related headwinds.

The US team is visiting India from August 25 to hold the next round of trade talks.

“We are hopeful that we will have an amicable solution,” Malhotra said.

The Indian government, meanwhile, has issued a firm rebuttal to President Trump’s comments on the country’s trade with Russia, calling them “unjustified and unreasonable.”

India, which has maintained a non-aligned position since the Ukraine war began in 2022, countered that it turned to Russian oil only after Western nations, particularly in Europe, diverted traditional energy supplies amid sanctions.

“The United States at that time actively encouraged such imports by India for strengthening global energy markets' stability,” the ministry said.

New Delhi pointedly highlighted the West’s apparent hypocrisy over ongoing trade with Russia, noting that both the US and EU continue to engage in substantial economic activity with Moscow, which is not limited to energy.

The statement revealed that in 2024, the European Union recorded goods trade with Russia worth €67.5 billion, along with €17.2 billion in services the previous year. EU imports of Russian liquefied natural gas (LNG) hit a record 16.5 million tonnes in 2024, surpassing 2022 levels.

“The very nations criticizing India are themselves indulging in trade with Russia. Unlike our case, such trade is not even a vital national compulsion,” the statement read.

The ministry also cited US imports of Russian uranium, palladium, fertilisers, and chemicals, underscoring that India’s own purchases are “meant to ensure predictable and affordable energy costs to the Indian consumer.”

Related News

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story