Business News

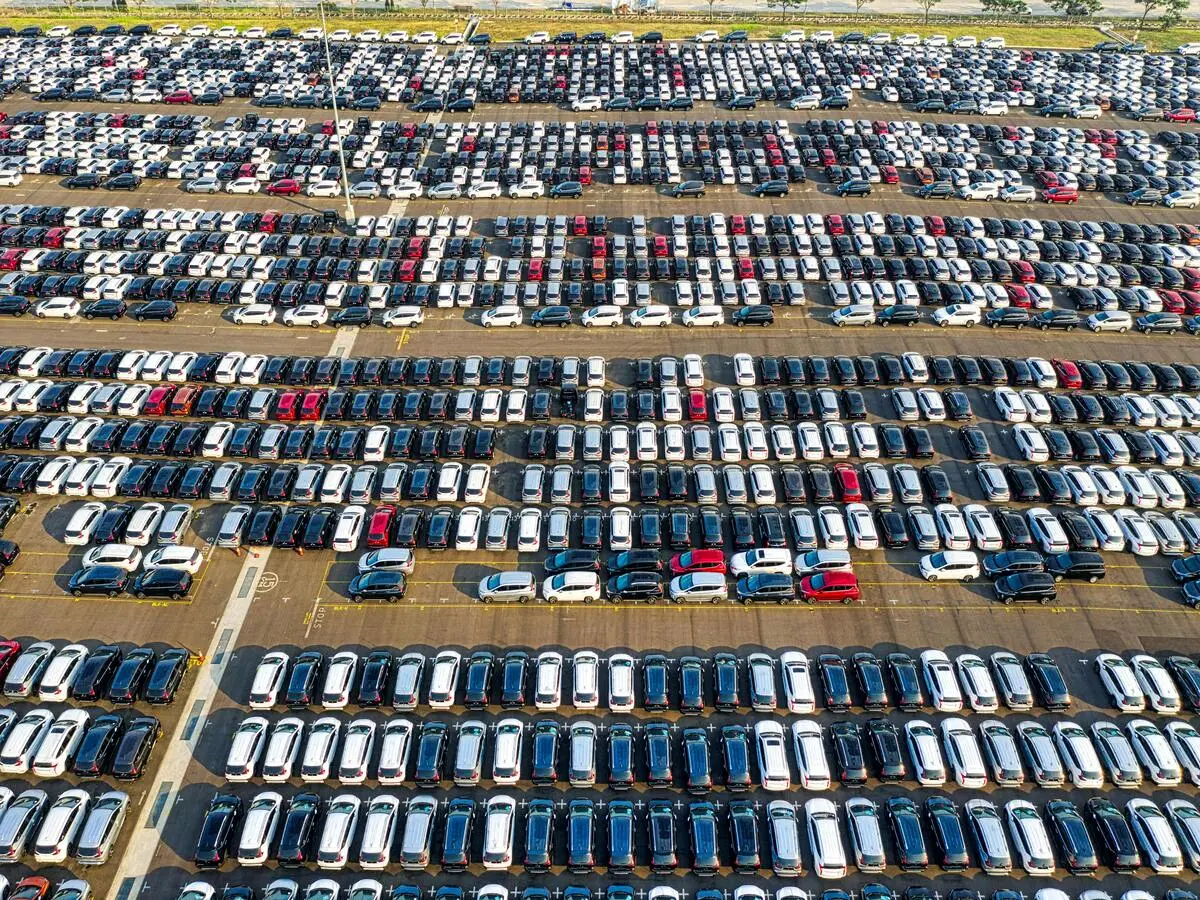

FADA urges OEMs to take corrective action as PV inventory rockets to record high

4 min read | Updated on October 07, 2024, 12:37 IST

SUMMARY

India's automobile retail sales fell 9% year-on-year in September, with significant declines in passenger vehicles and two-wheelers. FADA urged OEMs to take action amid high inventory levels and sluggish demand, despite the potential for recovery during the festive season.

Passenger vehicle sales declined 19 percent Y-O-Y to 2,75,681 units last month from 3,39,543 units in the year-ago period

Automobile retail sales in India declined 9 percent year-on-year in September amid a massive buildup of passenger vehicle inventory due to sluggish demand, dealer's body FADA said on Monday, urging original equipment manufacturers to take corrective steps.

The overall registrations declined to 17,23,330 units last month from 18,99,192 units in September 2023, as most of the categories including passenger vehicles and two-wheelers witnessed a year-on-year (Y-O-Y) drop.

"Despite the onset of festivals such as Ganesh Chaturthi and Onam, dealers have reported that the performance has been largely stagnant," Federation of Automobile Dealers Associations (FADA) President C S Vigneshwar said in a statement.

Given the critical festive season around the corner, FADA urges OEMs (Original Equipment Manufacturers) to take immediate corrective measures to avoid a financial setback, he said.

This suggests that overall market sentiment during these festive periods has been underwhelming, with a trend leaning towards flat or negative growth, he added.

Passenger vehicle sales declined 19 percent Y-O-Y to 2,75,681 units last month from 3,39,543 units in the year-ago period.

"Seasonal factors such as Shraddh and Pitrapaksha, coupled with heavy rainfall and a sluggish economy, have exacerbated the situation, leaving dealers with historically high inventory levels of 80-85 days' equivalent to 7.9 lakh vehicles worth Rs 79,000 crore," Vigneshwar said.

FADA also calls on the Reserve Bank of India to issue an advisory to banks, mandating stricter channel funding policies based only on dealer consent and on actual collateral, to prevent dealers from facing additional financial pressure due to unsold stock, he added.

This is the final opportunity for PV OEMs to recalibrate and support market recovery before it's too late, he said.

Two-wheeler retail sales saw a dip of 8 percent Y-O-Y to 12,04,259 units due to low consumer sentiment, poor inquiries, and reduced walk-ins, FADA said.

Shraddh period and heavy rains further impacted demand, resulting in delayed purchases and a subdued market environment, it added.

Commercial vehicle registrations declined 10 percent year on year last month to 74,324 units.

While there was positive sentiment and marginal growth in regions supported by infrastructure projects, overall demand remained weak due to low government spending, extended monsoon delays and seasonal challenges, the industry body said.

Three-wheeler sales retail sales rose marginally to 1,06,524 units last month as compared with 1,05,827 units in September 2023.

Tractor sales rose 15 percent year on year to 74,324 units last month.

For the April-September period, this fiscal, overall retail sales across segments witnessed a growth of 7 percent to 1,19,15,963 units against 1,11,83,734 units in the same period of last fiscal.

Passenger vehicle registrations rose 1 percent to 18,70,991 units as compared with 18,51,249 units in the year-ago period.

Two-wheeler sales increased 9 percent year on year to 85,66,531 in the first half of the current fiscal.

Commercial vehicle registrations, however, fell marginally to 4,77,381 units in the period under review from 4,80,488 units in H1 of last fiscal.

On near-term sales outlook, FADA said that while dealers and OEMs are betting on robust festive sales, especially in rural markets where positive cash flow and better agricultural conditions are expected to spur demand, the outcome remains uncertain.

A successful October is essential to clear out excess inventory and set a positive growth trajectory for the remainder of FY25, it said.

With rising inquiries and optimistic dealer sentiments, the outlook leans towards optimism, but high stakes and dependency on October's performance warrant a cautious approach, it added.

If the anticipated sales do not materialise, it could shift the outlook to pessimistic, putting dealers as well as OEMs in a difficult position heading into the new year, FADA said.

Vehicle retail data was collated from 1,365 out of 1,429 RTOs across the country, it added.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story