Business News

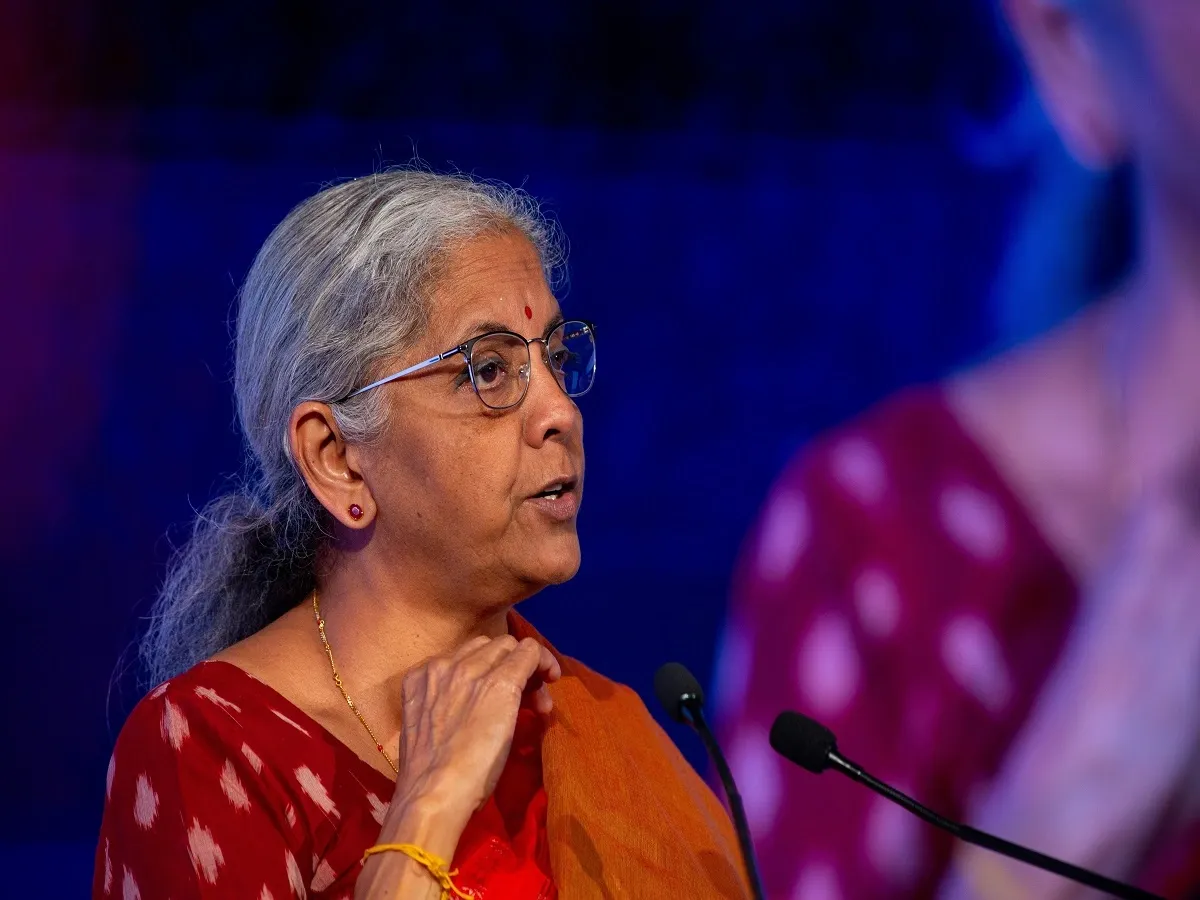

As Nirmala Sitharaman tables her seventh consecutive budget, read the full budget here

2 min read | Updated on July 23, 2024, 15:25 IST

SUMMARY

The Finance Minister Nirmala Sitharaman presents her seventh consecutive budget in the parliament. The budget has been endowed with the expectations of revisions in income tax, investments to drive job creation, and consolidation of the fiscal deficit to 5.1% of the GDP or less. The full budget can be read here.

During the Interim Budget, the Finance Minister had announced a record capex of ₹11.11 lakh crore, which amounts to 3.4% of the GDP.

Nirmala Sitharaman becomes the first Finance Minister in India’s history since Independence to present a seventh consecutive budget, breaking the record of the former Prime Minister Moraji Desai, who presented five consecutive budgets.

This is the first budget being presented under Narendra Modi’s third term as the Prime Minister, whose coalition government won the June Lok-Sabha election.

With anticipation built around the budget for weeks on end, and expectations pouring in from all sectors, ministries, and State Governments, Budget 2024 has been the talk of all citizens of India.

Changes in the income tax slabs, GST rationalisation, capital expenditure, welfare schemes, and much more have been anticipated.

Standard deduction under the new tax regime was increased from ₹50,000 to ₹75,000. The new tax regime saw revisions being made to the tax slabs.

During the Interim Budget, the Finance Minister had announced a record capex of ₹11.11 lakh crore, which amounts to 3.4% of the GDP, which has been retained for the current July budget.

Government may invest in large-scale projects such as urban development, ports, highways, and railways to boost job creation and create more opportunities. There were anticipations pouring in about investments in employment generation schemes in education and healthcare sectors.

The Reserve Bank of India (RBI) had posted a massive 141% increase in its net income which soared to ₹2.1 trillion in FY24. This massive dividend payout was expected to help the Union Government maintain its target of a fiscal deficit of 5.1% of the GDP, which was revised to an estimation of 4.9% of the GDP for this budget.

About The Author

Next Story