Business News

Understanding India’s very own “Hamara Bajaj” wealth creation journey

.png)

6 min read | Updated on November 08, 2024, 19:07 IST

SUMMARY

The Bajaj Group has contributed to over ₹10.90 lakh crore to market capitalisation with 10 listed companies. The giants of the group like Bajaj Finance and Finserv have been muted for the last few periods. However the group has still given whopping returns to investors, generating many-fold returns. Let's have a look towards individual stocks performance of the group, including their YoY profit growth and change in promoter holding.

Understanding India’s very own “Hamara Bajaj” wealth creation

Overview of Bajaj Group

The Bajaj Group, founded in 1926 by Jamnalal Bajaj, is a prominent Indian conglomerate with a diverse portfolio spanning automobiles, financial services, electricals, and consumer goods. Initially focused on trading and commodities, the group established Bajaj Auto in the 1940s, which became a household name in India with its iconic scooters, especially the Bajaj Chetak. Over the years, the group expanded into various sectors, including Bajaj Electricals, which produces a wide range of consumer electrical products, and Bajaj Hindusthan Sugar, one of the largest sugar manufacturers in the country.

In the early 2000s, the Bajaj Group strategically entered the financial services sector with the formation of Bajaj Finserv, which has since become a leader in offering loans, insurance, and wealth management services. Bajaj Auto continued to innovate with successful motorcycles like the Pulsar and Dominar, and it ventured into electric vehicles to stay ahead of industry trends. This ability to diversify and innovate while staying true to its core values has cemented the Bajaj Group's status as a key player in India's industrial landscape.

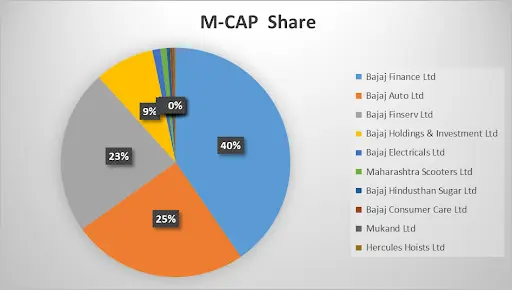

Stockwise Market Share

Top Performing stocks of Bajaj Group

| Stocks | Industry | NSE Price(₹) 21 June 2024 | M-CAP (₹ Crore) | Last 12 months returns |

|---|---|---|---|---|

| Bajaj Hindusthan Sugar Ltd | Agri Commodity | 43.13 | 5,509 | 164% |

| Hercules Hoists Ltd | Engineering | 590.05 | 1,888 | 114.41% |

| Bajaj Auto Ltd | Auto | 9,645.05 | 2,69,270 | 107.39% |

| Maharashtra Scooters Ltd | Auto | 8,335.00 | 9,526 | 52.80% |

It has 14 sugar factories with an aggregate sugarcane crushing capacity of 136,000 tonnes crushed per day (TCD). Besides Sugar, BHSL is also a leading manufacturer of ethanol. It has six distilleries with capacity to produce 800 kilo litre per day (KLPD) of industrial alcohol and owns 14 co-generation plants having power generating capacity of 449 MW.

Company has managed to reduce debt which has reduced interest cost, further narrowing the net losses.In coming years the sugar industry is expected to benefit from policy support from GOI in terms of MSP hike and ethanol policy.

The company’s financials saw record profit in FY23 with consolidated net profit at ₹103 crore from ₹15 crore in FY22.The operational margin has grown to 16% in FY24 from 6% in FY22. In the last 3 years the revenue, profit and stock price has compounded at 32%, 66% and 60% respectively.

The company has two operational facilities at Khalapur & Chakan both in Maharashtra.

Bajaj Auto is the world's fourth-largest manufacturer of motorcycles. It is also the largest manufacturer and seller of 3-wheelers globally.

In the last 3 years the company's sales, profit and stock price has compounded at 23%, 17% and 32% respectively.FY24 recorded the highest consolidated revenue for the company at ₹44,870 crore growing at 23% YoY basis.

In anticipation of support to the rural economy in the upcoming budget and above average monsoon, the rural demand is expected to grow which could potentially affect stock positively.

The company’ core revenue comes from investment activities which contribute over 95% and remaining through manufacturing.The company is almost debt free and has healthy dividend payout.

Other Bajaj stocks performance in last 12 months.

| Stocks | Industry | NSE Price (₹) 21 June 2024 | M-CAP (₹ Crore) | Last 12 months returns |

|---|---|---|---|---|

| Bajaj Consumer Care Ltd | FMCG | 271.86 | 3,878 | 43.34% |

| Mukand Ltd | Speciality Steel | 175.57 | 2,537 | 39.32% |

| Bajaj Holdings & Investment Ltd | Investment | 8,221.40 | 91,499 | 17.50% |

| Bajaj Finserv Ltd | Financial Services | 1,585.15 | 2,53,095 | 4.33% |

| Bajaj Finance Ltd | Financial Services | 7,107.70 | 4,40,072 | -1.31% |

| Bajaj Electricals Ltd | Consumer Electronics | 1,055.35 | 12,157 | -12.81% |

Glance on Net Profit, YoY growth and promoter holdings

| Stocks | Mar-23 (₹ Crore) | Mar-24 (₹ Crore) | YOY % change in Net Profit | Promoter Holding Mar-24 | Change in Promoter holding from Previous year |

|---|---|---|---|---|---|

| Bajaj Holdings & Investment Ltd | 4,946 | 7,365 | 48.91% | 51.46% | 0.00% |

| Bajaj Hindusthan Sugar Ltd | -135 | -87 | 35.56% | 24.96% | 0.00% |

| Bajaj Finserv Ltd | 12,210 | 15,595 | 27.72% | 60.69% | -0.09% |

| Bajaj Auto Ltd | 6,060 | 7,708 | 27.19% | 55.06% | 0.07% |

| Bajaj Finance Ltd | 11,508 | 14,451 | 25.57% | 54.69% | -1.22% |

| Bajaj Consumer Care Ltd | 139 | 155 | 11.51% | 39.30% | 0.14% |

| Maharashtra Scooters Ltd | 195 | 199 | 2.05% | 51.00% | 0.00% |

| Mukand Ltd | 172 | 103 | -40.12% | 74.70% | 0.34% |

| Bajaj Electricals Ltd | 231 | 132 | -42.86% | 10.18% | -1.04% |

| Hercules Hoists Ltd | 103 | 36 | -65.05% | 69.61% | -0.01% |

Conclusion -

Out of 10 Bajaj stocks, 3 stocks have given triple digit returns, another 3 stocks have given double digit returns and only two stocks Bajaj Finance and Bajaj Electricals have given negative returns in the last 12 months. Bajaj Finserv has given a muted return of 4.33% in the last 12 months.

In terms of net profit growth 7 companies out of 10 have reported YoY growth in net profit led by Bajaj Holding and Investment, Bajaj Hindustan, Bajaj Finserv, Bajaj Auto and Bajaj Consumer which have shown double digit growth in net profit on YoY basis.

The 3 stocks have underperformed in the group namely Bajaj Finance, Bajaj Finserv and Bajaj Electricals in last year and these three stocks have also seen decrease in promoter holding corresponding to FY23 by (-) 1.22%, (-) 0.09% and (-) 1.04%.Hercules Hoist too saw dip in promoter stake marginally by (-) 0.01%.

About The Author

Next Story