Business News

JM Financial Mutual Fund Launches Small Cap Fund Scheme: JM Small Cap Fund

.png)

5 min read | Updated on May 27, 2024, 20:38 IST

SUMMARY

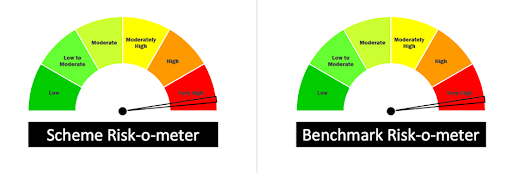

JM Financial Mutual Fund introduces JM Small Cap Fund, focusing on small-cap equity investments for long-term growth. The high-risk fund opens for subscription from May 27, 2024, to June 10, 2024, with no entry load and a 1% exit load within six months.

The NFO starts on May 27 and ends on June 10

JM Small Cap Fund is launching a new fund offer! It's an open-ended equity mutual fund that invests mostly in small companies, to grow your wealth over the long term. This is a high-risk investment, but that's also true of the small-company market in general. Units are initially priced at ₹10 each, the minimum investment is ₹5,000 and additional investments can be made of ₹1,000 thereafter. There is no upper limit for investment. Also, there are no fees to buy in, but if you sell your units within 6 months of buying them, you'll pay a 1% exit load. The new fund offer opens on May 27th, 2024, and closes on June 10th, 2024. The fund will reopen for regular purchases and sales on June 25th, 2024.

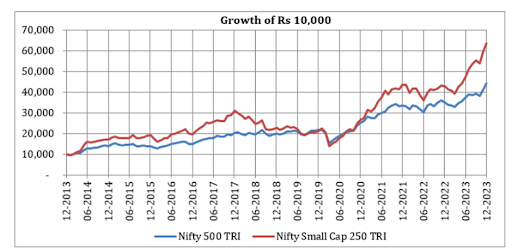

Small caps have outperformed the broader markets. Observe the growth of ₹10,000 lumpsum investment in the Nifty 250 small-cap TRI over the last 10 years compared to the returns of the broad market index Nifty 500 TRI. Notice that the small-cap has mostly outperformed the broad market index returns by a wide margin. NIFTY 250 Small Cap TRI has given 20.77% CAGR returns compared to NIFTY 500 TRI which gave 16.22% CAGR returns in the last 10 years.

JM Small Cap Fund (Direct Plan)

The primary objective of the JM Small Cap Fund is to generate long-term capital appreciation by investing predominantly in equity and equity-related securities of small-cap companies, as defined by SEBI. However, there is no assurance that the investment objective of the Scheme will be achieved. The Scheme does not guarantee/indicate any returns.

The performance of the JM Small Cap Fund Index Fund is benchmarked against Nifty Smallcap 250 TRI.

| Types of Instruments | Risk Profile | Minimum Allocation | Maximum Allocation |

|---|---|---|---|

| Equity - small-cap companies | Very High | 65% | 100% |

| Equity - other than small-cap companies | Very High | 0% | 35% |

| Debt & Money Market | Low to Medium | 0% | 35% |

| REITs and InvITs | Medium to High | 0% | 10% |

| Mutual Fund Schemes | Medium to High | 0% | 10% |

Larger Universe of Small-Cap Stocks Small cap sphere of stocks is much bigger than either mid-caps or large caps. The small cap features 537 stocks above the market cap of ₹2,000 crores and above. This large universe of stocks provides greater opportunities for the creation of alpha. This is because the fund manager may be able to identify stocks with significant growth prospects.

Peer Schemes

| Scheme Name (Direct Plan) | AUM (Crore) | Expense Ratio (%) | 1 Year Returns (%) | 3 Years Returns (%) | 5 Years Returns (%) | Since Launch Returns (%) |

|---|---|---|---|---|---|---|

| Nippon India Small Cap | 50422.78 | 0.68 | 60.32 | 34.93 | 32.68 | 27.56 |

| SBI Small Cap | 27759.65 | 0.67 | 40.65 | 24.26 | 27.35 | 26.29 |

| Axis Small Cap | 20136.63 | 0.52 | 39.88 | 25.28 | 28.47 | 25.23 |

| HSBC Small Cap Fund | 14619.42 | 0.68 | 53.73 | 32.59 | 27.84 | 23.85 |

| Kotak -Small Cap | 14815.19 | 0.46 | 43.93 | 24.37 | 29.6 | 21.49 |

| HDFC Small Cap | 29685.32 | 0.67 | 45.57 | 29.05 | 24.95 | 21.08 |

| Quant Small Cap | 20164.09 | 0.64 | 71.16 | 36.04 | 41.9 | 20.03 |

| NIFTY SMALLCAP 250 TRI | - | - | 64.21 | 27.53 | 25.9 | 16.91 |

| Category Average | - | - | 51.95 | 28.24 | 28.88 | 24.76 |

Who Manages the Scheme?

Asit Bhandarkar is a Senior Fund Manager specializing in equity, with a B.Com. and MMS, aged 45. Recently worked as a Fund Manager at Lotus India Asset Management Company Pvt. Ltd, he comes along with 20 years of experience in equity research and fund management, where two years plus were spent at SBI Funds Management Pvt. Ltd. as a Junior Fund Manager before joining them. Earlier on, he served approximately two years as an equity analyst on the broking side whilst employed by Jet Age Securities and Sushil Finance Consultants.

Chaitanya Choksi is a Fund Manager specialising in equity, holding an MMS in Finance and a CFA, aged 46. He has been with JM Financial Asset Management Limited since 2008 and has approximately 23 years of experience in equity research as well as capital markets. Before this, he worked with Lotus India Asset Management Company Pvt. Ltd., Chanrai Finance Private Limited, IL & FS Investsmart, and UTI Investment Advisory Services Ltd.

Gurvinder Singh Wasan is a Senior Fund Manager and Credit Analyst specialising in debt, with an M.Com., Chartered Accountant qualification, and CFA Charter, aged 43. He has over 20 years of experience in fixed-income markets, having worked as a fund manager and credit analyst at a mutual fund, and as a structured finance manager at a rating agency and a bank. His previous employers include ICICI Bank, CRISIL, and Principal Asset Management Company. Investing in small-cap funds like JM Small Cap Fund offers the potential for significant returns, leveraging a broad stock universe. However, investors should be mindful of the inherent high risks and align investments with their risk tolerance and financial goals.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story