Business News

Evolution of Murugappa Group: From a small bank in Burma to diversified businesses in India

.png)

5 min read | Updated on June 22, 2024, 17:25 IST

SUMMARY

From a small bank in Burma, The Murugappa Group has now diversified into finance, agri-solutions and engineering and is valued at ₹3,08,053 crores.

.webp)

Evolution and Impact: The Murugappa Group Journey

The Murugappa Group is a typical example of India’s entrepreneurial spirit, originating from a small banking venture in Burma (now Myanmar) prior to World War I. As war threatened, the Group tactically moved southwards into India starting its transformative era. It expanded beyond banking into agri-solutions, financial services and engineering recognizing the peculiarly Indian agrarian economy as well as the country’s booming industrial landscape. Adaptability over time and innovative approaches have made the group leaders in these main areas.

Today, Murugappa Group employs more than 73,000 people. Their success is based on governance, ethical practices and value creation that strike a balance between achieving commercial goals and creating social good. The evolution of this organization from a small bank start-up to international behemoth reflects their determination, foresight and constant attention to community benefits.

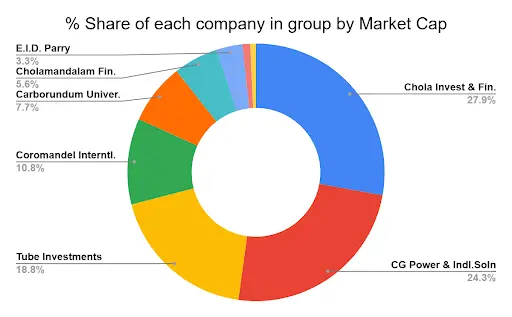

This has been achieved by the Murugappa Group through enclaving 29 businesses including nine publicly listed companies producing abrasives, auto components, bicycles, fertilizers and sugar among others. The Market Cap for the 9 listed companies of the group on today's date is ₹3,08,053 crore (as on 21/06/2024).

| Sr. No. | Company | LTP | Market Cap in ₹ Cr. | ROE | P/E | P/BV | EV/EBITDA |

|---|---|---|---|---|---|---|---|

| 1 | Chola Invest & Fin. | 1,416 | 1,18,993 | 20.61 | 35.34 | 6.17 | 15.74 |

| 2 | CG Power & Indl.Soln | 680 | 103,924 | 56.99 | 72.78 | 34.42 | 83.45 |

| 3 | Tube Investments | 4,146 | 80,197 | 22.18 | 67.81 | 15.97 | 36.77 |

| 4 | Coromandel Interntl. | 1,562 | 45,995 | 29.76 | 29.49 | 5.14 | 17.34 |

| 5 | Carborundum Universal. | 1,719 | 32,703 | 14.5 | 72.16 | 10.66 | 40.27 |

| 6 | Cholamandalam Fin. | 1,279 | 24,013 | 4.78 | 13.6 | 18.78 | 292.41 |

| 7 | E.I.D. Parry | 786 | 13,956 | 5.85 | 15.5 | 4.88 | 49.84 |

| 8 | Shanthi Gears | 544 | 4,173 | 23.72 | 50.24 | 9.23 | 26.62 |

| 9 | Wendt India | 15,461 | 3,092 | 24.72 | 77.79 | 16 | 50.61 |

Source: Screener as on 21/06/2024

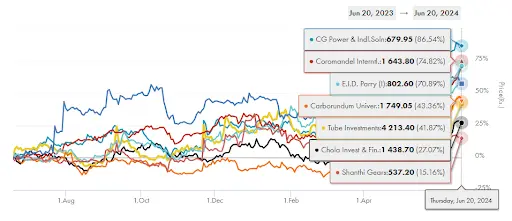

1 Year Return by Group of Companies:

Source: Tijori Finance as on 21/06/2024

Cholamandalam Investment & Finance Company is one of the premier diversified non-banking finance companies in India. For Quarter ending March 2024, Disbursements increased by 18% to ₹24,784 crores, while the total AUM reached ₹1,53,718 crores, marking a 36% year-on-year growth. Net income for the quarter rose by 41% to ₹2,913 crores, and the PAT increased by 24% to ₹1,058 crores. Additionally, disbursement growth in other business segments was at 24%.

CG Power and Industrial Solutions

CG Power & Industrial Solutions is a global enterprise offering comprehensive solutions for efficient and sustainable electrical energy management to utilities, industries, and consumers. By the end of FY24 the company doubled Power Transformer capacity from 17,000 MVA to 35,000 MVA, with an expected revenue potential of ₹1800 crores, and increasing Distribution Transformer capacity by 50%.

Tube Investments

Tube Investments of India Limited (TII) is a leading manufacturer of diverse products for industries like automotive, railway, construction, mining, and agriculture. The company plans to expand its electric vehicle business, including three-wheelers, trucks, tractors, and small commercial vehicles, with an investment of around ₹471 crores for the ongoing financial year.

Coromandel International

Specializes in a wide array of products and services across the farming value chain, including fertilizers, crop protection, bio-pesticides, specialty nutrients, and organic fertilizers, contributing significantly to agricultural productivity and sustainability. By the end of Q4 2024, plants operated at nearly 95% capacity, prompting plans for debottlenecking and establishing new plants. Additionally, the company is venturing into specialty chemicals and exploring new chemistries such as fluorination chemistry.

Dispute among the group

Following the demise of MV Murugappan, disputes started cropping up in the Murugappa household, with Valli Arunachalam as the first born child filing a case at NCLT. She cites gender based discrimination by asking for board representation and a fair exit from her shares in Murugappa Group. Arunachalam is MM Murugappan’s second cousin who is part of the top management team at the group.

However, they were later said to have discussed and agreed on the terms of their family arrangement during one of their meetings. The family arrangement was primarily aimed at fostering amiability and good will among the members of Murugappa family.

Promoter Holdings as of March 2024

| Company | Promoter Holdings | Market Cap |

|---|---|---|

| Chola Invest & Fin. | 50.35% | 1,18,993 |

| CG Power & Indl.Soln | 58.11% | 103,924 |

| Tube Investments | 45.10% | 80,197 |

| Coromandel Interntl. | 57.32% | 45,995 |

| Carborundum Univer. | 41.23% | 32,703 |

| Cholamandalam Fin. | 50.35% | 24,013 |

| E.I.D. Parry | 42.23% | 13,956 |

| Shanthi Gears | 70.47% | 4,173 |

| Wendt India | 75% | 3,092 |

Source: Trendlyne

The Murugappa Group is one of the most successful companies in India, with a market capitalization of ₹3,08,053 crores and presence in over 50 countries. It has transformed over the century from bicycles to agrochemicals while still showing flexibility and resourcefulness. The group’s focus on sustainable development and international partnerships portends well for its future.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story