RBI MPC February Meeting 2026 Highlights: Reserve Bank keeps repo rate unchanged at 5.25%

.png)

5 min read | Updated on February 06, 2026, 13:10 IST

SUMMARY

RBI MPC February Meeting 2026 Highlights: RBI Governor Sanjay Malhotra said that the Monetary Policy Committee (MPC) has decided to keep the repo rate unchanged at 5.25%. The stance has been maintained as 'neutral'.

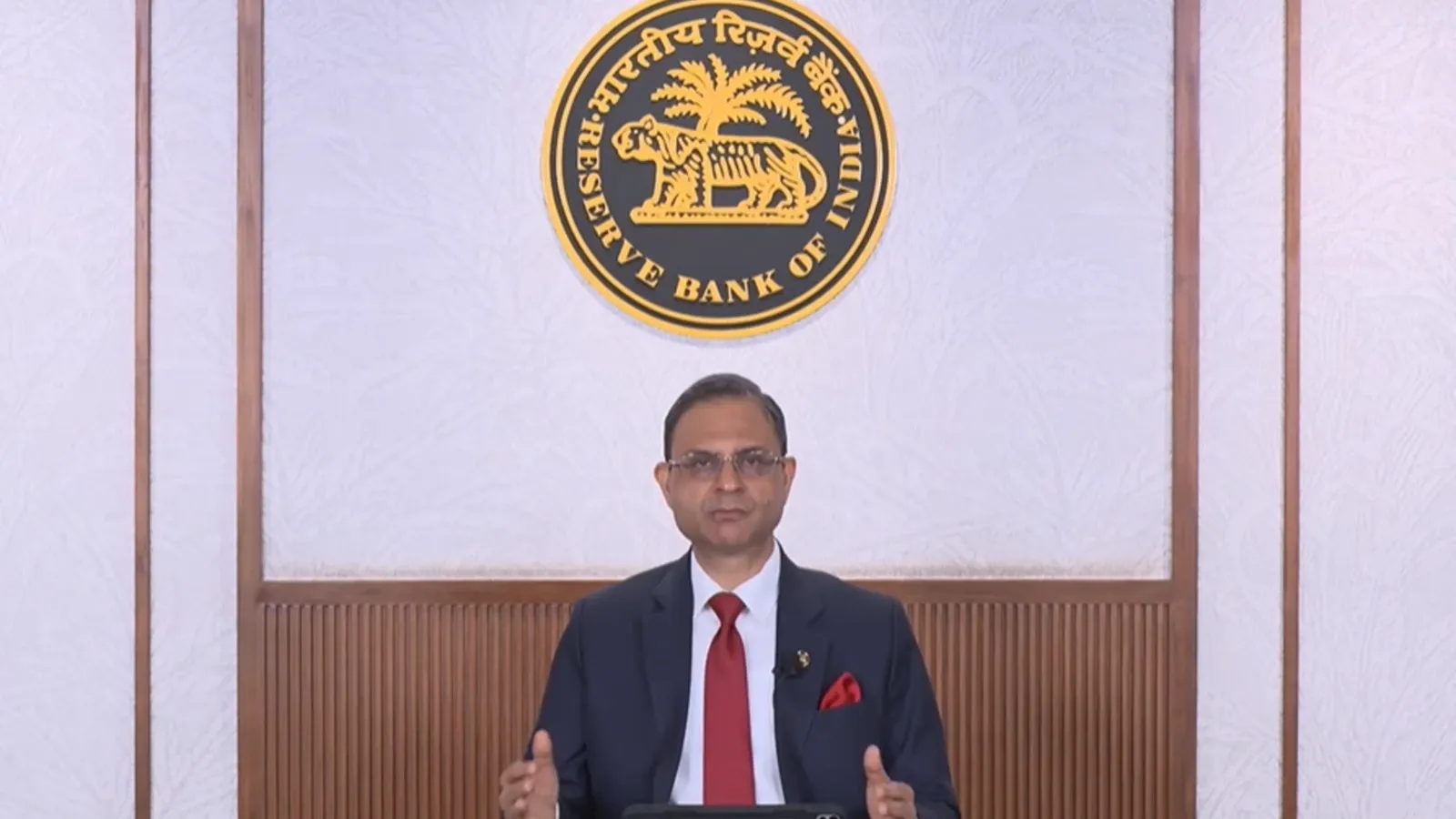

Reserve Bank of India MPC consists of three members from the RBI and three external members appointed by the government. | Image: YouTube/RBI

RBI MPC February Meeting 2026 Live Updates: Next MPC meet on April 6-8

RBI MPC February Meeting 2026 Live Updates: The next meeting of RBI's monetary policy committee is scheduled for April 6-8, 2026.

February 06, 2026, 13:10 PM

RBI MPC February Meeting 2026 Live Updates: Reserve Bank marginally raises inflation projection on higher precious metals prices

RBI MPC February Meeting 2026 Live Updates: The Reserve Bank on Friday, February 6, revised upwards inflation projection for the current fiscal year to 2.1% and for first and second quarters of the next financial year, mainly due increase in prices of precious metals.

February 06, 2026, 12:39 PM

RBI MPC February Meeting 2026 Live Updates: Auto, bank, financial, real estate stocks trade in red

RBI MPC February Meeting 2026 Live Updates: Rate-sensitive stocks, including those in real estate, banking, financial services, and auto sectors, were trading in the negative territory on Friday, February 6. Read More.February 06, 2026, 12:01 PM

RBI MPC February Meeting 2026 Live Updates: India’s forex reserves stood at USD 723.8 bn

RBI MPC February Meeting 2026 Live Updates: The forex reserves of India stood at USD 723.8 billion, Reserve Bank of India Governor Sanjay Malhotra said.

February 06, 2026, 11:12 AM

RBI MPC February Meeting 2026 Live Updates: RBI Guv proposes to set up unified portal for better management of Lead Bank data

RBI MPC February Meeting 2026 Live Updates: The Reserve Bank of India on Friday, February 6, proposed to set up unified portal for better management of Lead Bank data, Governor Sanjay Malhotra said.

February 06, 2026, 10:45 AM

RBI MPC February Meeting 2026 Live Updates: RBI Guv proposes framework to compensate customers for losses in fraudulent transactions

RBI MPC February Meeting 2026 Live Updates: RBI MPC February Meeting 2026 Live Updates: Reserve Bank of India Governor Sanjay Malhotra proposed to introduce a framework to compensate customers up to ₹25,000 for losses incurred in fraudulent transactions.

February 06, 2026, 10:37 AM

RBI MPC February Meeting 2026 Live Updates: System liquidity remained at ₹75,000 crore on daily average basis, says RBI Guv

RBI MPC February Meeting 2026 Live Updates: System liquidity remained at ₹75,000 crore on daily average basis and RBI took several steps to boost liquidity in December-January period, Governor Sanjay Malhotra said.

"RBI will remain pro activity in liquidity management to meet productive requirements of economy. G-sec yields continued to harden over last eight months mirroring global trends," he said.

February 06, 2026, 10:28 AM

RBI MPC February Meeting 2026 Live Updates: RBI will allow banks to lend to REITs with certain safeguards, says Guv Malhotra

RBI MPC February Meeting 2026 Live Updates: The Reserve Bank of India will allow banks to lend to Real Estate Investment Trusts (REITs) with certain safeguards, Governor Sanjay Malhotra said.

February 06, 2026, 10:26 AM

RBI MPC February Meeting 2026 Live Updates: Limit of collateral-free loan to MSMSe hiked to ₹20 lakh

RBI MPC February Meeting 2026 Live Updates: Limit of ₹10 lakh collateral-free loan to MSMSe has been hiked to ₹20 lakh, RBI Governor Sanjay Malhotra said.

February 06, 2026, 10:23 AM

RBI MPC February Meeting 2026 Live Updates: RBI revises upwards growth projection for Q1, Q2 of FY27

RBI MPC February Meeting 2026 Live Updates: The Reserve Bank of India has revised upwards growth projection for Q1 and Q2 of next fiscal year at 6.9% and 7%, respectively.

The real GDP is poised to register a higher growth of 7.4% compared with the previous year, Governor Malhotra said.

February 06, 2026, 10:18 AM

RBI MPC February Meeting 2026 Live Updates: India-EU FTA, trade deal with US will support export momentum

RBI MPC February Meeting 2026 Live Updates: RBI Governor Sanjay Malhotra said that recently concluded India-EU FTA, prospective India-US trade deal will support export momentum.

February 06, 2026, 10:14 AM

RBI MPC February Meeting 2026 Live Updates: Indian economy remains resilient, says RBI Governor

RBI MPC February Meeting 2026 Live Updates: Addressing from the RBI headquarters, Governor Sanjay Malhotra said that that Indian economy remains resilient.

"Domestic inflation and growth outlook remain positive," he said.

February 06, 2026, 10:10 AM

RBI MPC February Meeting 2026 Live Updates: Reserve Bank keeps repo rate unchanged at 5.25%

RBI MPC February Meeting 2026 Live Updates: RBI Governor Sanjay Malhotra said that the Monetary Policy Committee (MPC) has decided to keep the repo rate unchanged at 5.25%. The stance has been maintained as 'neutral'.

"The Monetary Policy Committee met on 4th, 5th (February) and today to deliberate and decide on policy repo rate. After a detailed assessment of evolving macro-economic condition and the economic outlook, the MPC voted unanimously to keep the policy repo rate unchanged at 5.25%," he said. Read More.February 06, 2026, 10:25 AM

RBI MPC February Meeting 2026 Live Updates: Governor Sanjay Malhotra's address begins

RBI MPC February Meeting 2026 Live Updates: RBI Governor Sanjay Malhotra addresses the media from the Reserve Bank of India Headquarters on decisions taken during the three-day Monetary Policy Committee (MPC) meeting.

February 06, 2026, 10:04 AM

RBI MPC February Meeting 2026 Live Updates: RBI likely to maintain the status quo, says SBI research report

RBI MPC February Meeting 2026 Live Updates: A SBI research report said that since the last MPC in December, one of the major policy changes is the EU-India and US-India trade deals, resulting in a reduction in tariffs on India to 18% from 50% earlier.

Clearly, India now has one of the lowest tariffs among Asian countries, which will help in improving our export competitiveness, it said.

"We observe that despite policy rate easing, government bond yields have exhibited persistent hardening in recent periods. We believe that the choice of eligible securities itself may influence the effectiveness of OMO operations, even when the aggregate quantum of liquidity injection is unchanged," it said.

The RBI is thus likely to maintain the status quo in the upcoming policy, the SBI study said.

February 06, 2026, 09:55 AM

RBI MPC February Meeting 2026 Live Updates: RBI's MPC is likely to pause its rate cuts, says BLS E-Services

RBI MPC February Meeting 2026 Live Updates: Lokanath Panda, COO, BLS E-Services, said Union Finance Minister Nirmala Sitharaman has presented Budget 2026-27, targeting broad-based productivity gains and employment generation through structural reforms and new infrastructure.

"Against this backdrop, the RBI's MPC is likely to pause its rate cuts. Having already lowered the repo rate by 125 basis points since early 2025, with the last cut in December, which helped the banks' interest rate reduction and increased liquidity in the market, we expect the central bank to be now poised to concentrate on liquidity conditions, bond market stability, and currency risk management," Panda said.

February 06, 2026, 09:24 AM

RBI MPC February Meeting 2026 Live Updates: What is the current repo rate

RBI MPC February Meeting 2026 Live Updates: The Reserve Bank of India (RBI) has kept key repo rate at 5.25%.

The RBI reduced the key short-term lending rate (repo) by 125 basis points in four tranches, beginning in February, amid declining consumer price index (CPI) based inflation.

February 06, 2026, 08:57 AM

RBI MPC February Meeting 2026 Live Updates: RBI's rate-cutting cycle appears to be over for now, says BofA Global Research

RBI MPC February Meeting 2026 Live Updates: A Bank of America Global Research note said the Reserve Bank's rate-cutting cycle appears to be over for now.

The trade deal now would boost the growth certainty, and the current momentum seen in high-frequency indicators can continue to sustain, it said.

"We also believe the RBI is now done cutting rates but will continue to manage its liquidity provisions carefully to ensure rate transmission remains active," the note said.

February 06, 2026, 08:40 AM

RBI MPC February Meeting 2026 Live Updates: What to expect from the bi-monthly MPC meet

RBI MPC February Meeting 2026 Live Updates: RBI Governor Sanjay Malhotra-led Monetary Policy Committee (MPC) is widely expected to maintain the status quo on key interest rates when it announces its bi-monthly monetary policy decision on Friday, February 6. Read Full Report.February 06, 2026, 08:19 AM

RBI MPC February Meeting 2026 Live Updates: Governor Sanjay Malhotra speech live streaming

RBI MPC February Meeting 2026 Live Updates: Reserve Bank Governor Sanjay Malhotra's address will be live streamed on RBI's official YouTube channel.February 06, 2026, 08:02 AM

RBI MPC February Meeting 2026 Live Updates: Date and time of monetary policy statement

RBI MPC February Meeting 2026 Live Updates: Sanjay Malhotra, Governor of Reserve Bank of India (RBI), will announce the monetary policy statement on Friday, February 6, 2026, at 10 am.

February 06, 2026, 08:01 AM

RBI MPC February Meeting 2026 Live Updates: Governor Sanjay Malhotra to announce monetary policy today

RBI MPC February Meeting 2026 Live Updates: Reserve Bank of India Governor Sanjay Malhotra will declare the bi-monthly monetary policy on Friday, February 6, 2026.

February 06, 2026, 08:19 AM