Business News

RBI MPC Meeting 2024 Highlights: Repo rate unchanged at 6.5%, CRR cut by 50 bps to 4%

.png)

5 min read | Updated on December 06, 2024, 11:02 IST

SUMMARY

RBI MPC Meeting 2024 Highlights: The Reserve Bank of India (RBI) has kept the repo rate at 6.5%, maintaining its stance for the 11th consecutive time.

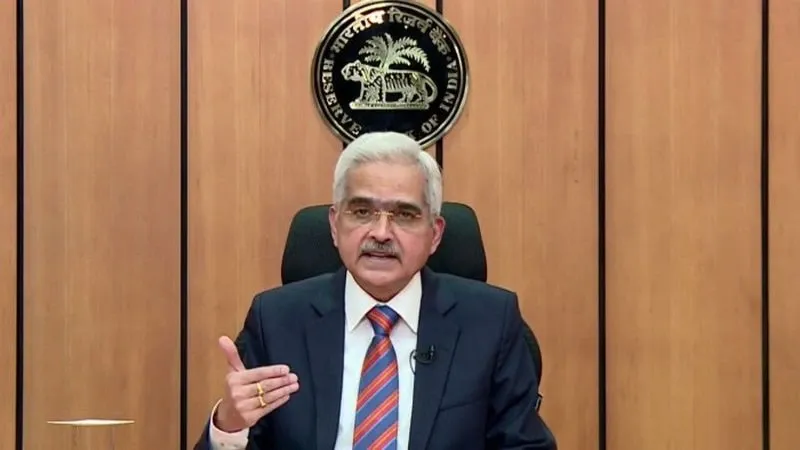

Reserve Bank Governor Shaktikanta Das is chairing the last MPC meeting of his current term which ends on December 10.

The Cash Reserve Ratio (CRR) is the mandatory deposit percentage that banks must maintain with the RBI. In the December MPC meeting, the committee reduced CRR by 50 bps to 4%.

A cut of 50 bps frees up around ₹1.1 lakh crore to ₹1.2 lakh crore for lending.

"Only durable price stability is necessary to secure a strong foundation of growth," he said.

RBI maintains the status quo for the 11th consecutive time by a majority of 4:2.

RBI Governor Shaktikanta Das addresses the media on decisions taken during the three-day Monetary Policy Committee (MPC) meeting.

According to the experts, the Reserve Bank of India is unlikely to change the repo rate on Friday but may tinker with the cash reserve ratio (CRR).

The RBI has maintained the repo or short-term lending rate at 6.5% since February 2023. The last increase took place in February 2023, when the rate was raised to 6.5%, and it has remained at that level since then.

Suman Chowdhury, Executive Director and Chief Economist of Acuitè Ratings said the economic outlook is marked by uncertainty about growth and caution about inflation.

A cut in CRR would infiltrate liquidity into the banking system, cushioning economic activity without directly affecting the repo rate. Between December 2024 and February 2025, Chowdhury said, a 50-bps cut in CRR is significantly likely, bringing it to 4% from 4.5%.

"Coming up: Monetary Policy Statement by #RBI Governor @DasShaktikanta on December 06, 2024, at 10:00 am," the Reserve Bank of India announced on X.

- Shaktikanta Das, Governor, RBI

- Nagesh Kumar, Director and Chief Executive, Institute for Studies in Industrial Development, New Delhi

- Saugata Bhattacharya, Economist

- Ram Singh, Director, Delhi School of Economics

- Rajiv Ranjan, Executive Director, RBI

- Michael Debabrata Patra, Deputy Governor, RBI

RBI MPC Meeting 2024 LIVE: The Reserve Bank of India (RBI) will declare its decision on interest rate after Friday's three-day monetary policy panel meeting amid high inflation and poor gross domestic product (GDP) growth numbers.

RBI MPC Meeting 2024: Will Governor Shaktikanta Das-led committee cut repo rate or CRR?

According to analysts, the central bank is expected to keep the short-term lending rate (repo) unchanged and may possibly cut the cash reserve ratio (CRR), given the mixed economic trends.

The six-member Monetary Policy Committee (MPC), which Reserve Bank Governor Shaktikanta Das leads, started its bi-monthly monetary policy on Wednesday.

Notably, Das is chairing his current team's last monetary committee meeting, which will end on December 10.

The repo rate, or short-term lending rate, was last hiked to 6.5% in February 2023, and since then, the RBI has kept it unchanged.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story