Business News

RBI MPC 2024 Highlights: Repo rate stays 6.5%, FY25 GDP growth forecast raised to 7.2%

.png)

5 min read | Updated on June 07, 2024, 12:30 IST

SUMMARY

RBI Monetary Policy 2024: The six-member Reserve Bank of India (RBI) Monetary Policy Committee (MPC) will announce the outcome of the three day meeting on Friday at 10 am.

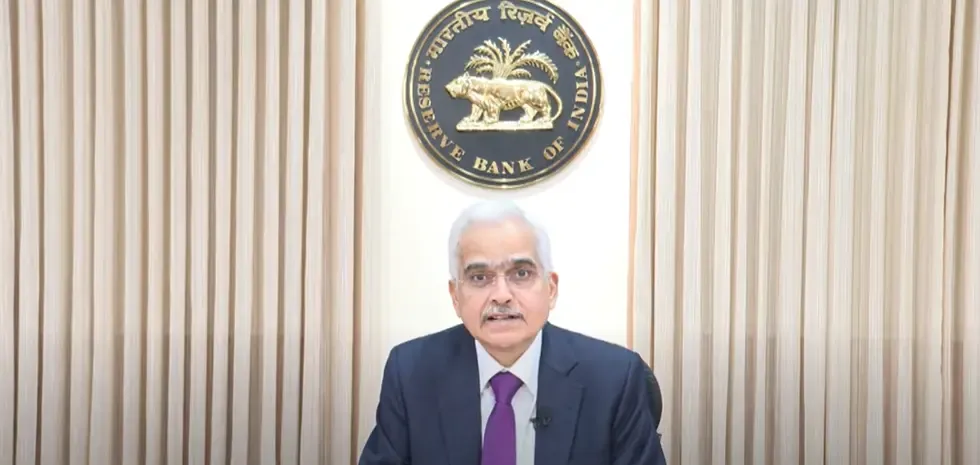

RBI Governor Shaktikanta Das

The Reserve Bank of India’s Monetary Policy Committee headed by Governor Shaktikanta Das kept the key policy rates unchanged for the eighth straight time on Friday.

In its second bi-monthly monetary policy of 2024-25 released on June 7, the RBI kept the repo rate or overnight lending rate at 6.5% while observing that the inflation growth balance was moving favourably.

"As you would be aware, the Central Board of the Reserve Bank decided to transfer ₹2.11 lakh crore as surplus to the Central Government for the accounting year 2023-24. As the economy remains robust and resilient, the Board decided to utilise this opportunity to increase the risk provisioning under the contingent reserve buffer (CRB) to 6.5% of the Reserve Bank’s balance sheet for 2023-24 from 6% in 2022-23. This would further strengthen the Reserve Bank’s balance sheet. Prudence is at the core of our standard operating procedure," Das said.

"The outlook on crude oil prices remains uncertain due to geopolitical tensions. Assuming a normal monsoon, CPI inflation for 2024-25 is projected at 4.5% with Q1 at 4.9%, Q2 at 3.8%, Q3 at 4.6% and Q4 at 4.5%, the risks are evenly balanced. The GDP growth projection, we have increased it from 7% to 7.2% and the inflation projection, the average for the year, we have retained it at 4.5% as it was in the last MPC meeting. I have explained there are good reasons why we have increased the GDP projection for the current year," Das said.

"The inflation growth balance is moving favorably. Growth is holding firm. Inflation continues to moderate, mainly driven by the core component, which reached its lowest level in the current series In April 2024. The deflation in fuel prices is ongoing. Food inflation, however, remains elevated. While the MPC took note of the disinflation achieved so far without hurting growth, it remains vigilant to any upside risks to inflation, particularly from food inflation, which could possibly derail the path of disinflation. Hence, monetary policy must continue to remain disinflationary and be resolute in its commitment to aligning inflation to the target of 4% on a durable basis. Sustained price stability would set strong foundations for a period of high growth. Accordingly, the MPC decided to keep the policy repo rate unchanged at 6.5% in this meeting of the MPC. The MPC also decided to remain focused on withdrawal of accommodation to ensure anchoring of inflation expectations and fuller policy transmission," Governor Shaktikanta Das said.

RBI Governor Shaktikanta Das said that the real GDP growth for current financial year 2024-25 is projected at 7.2% with first quarter at 7.3%, second quarter at 7.2%, third quarter at 7.3%, and fourth quarter at 7.2%. "The risks are evenly balanced," he added.

Reserve Bank of India (RBI) Governor Shaktikanta Das has announced that the repo rate has been kept unchanged at 6.50% for the eighth time in a row. It was decided by 4:2 majority.

- RBI Governor: Chairperson

- Deputy Governor of RBI, in charge of Monetary Policy: Member

- One officer of RBI nominated by the Central Board: Member

- Professor Ashima Goyal, Indira Gandhi Institute of Development Research: Member

- Professor Jayanth R Varma, Indian Institute of Management, Ahmedabad: Member

- Dr Shashanka Bhide, Senior Advisor of National Council of Applied Economic Research, Delhi: Member

Reserve Bank of India (RBI) Governor Shaktikanta Das will announce the decision made during the three-day MPC meeting on key interest rates at 10 am on Friday.

RBI Monetary Policy 2024: The six-member Reserve Bank of India (RBI) Monetary Policy Committee (MPC) will announce the outcome of the three day meeting on Friday at 10 am.

The MPC meets at least four times a year to decide on the policy repo rate necessary to reach the inflation target. Each member has one vote, and in the event of a tie, the Governor has a second or casting vote. Also, each MPC member writes a statement detailing the reasons for their vote on the proposed resolution.

About The Author

Next Story