How To Open An Upstox Demat Account

Quick & Secure Onboarding

All data is stored safely with encryption as per regulatory guidelines.

Step 1

Verify KYC & bank details

Step 2

eSign

Step 3

Download the app & start trading

₹0

Account Opening

Demat + Trading

₹0

Commission

Mutual Funds and IPOs

₹0

Demat AMC

Account Maintenance Charges

₹20

Brokerage

Equity, F&O, Commodity and Currency orders

*Zero AMC Is Applicable For Customers Onboarded After August 2021

Awards and Accolades

Go to ‘Account’ → Enable ‘Upstox for Investor’

Most promising broking house of the year

2019

Highest Number Of Accounts in a Single Month by a broker

2019, 2020

Best innovation in wealth management

2020

Highest Number Of Demat Accounts in a Single Month

2021

Demat 101

Everything you need to know about opening a Demat Account

What is a Demat account?

A Demat (short for Dematerialized) is an electronic account used to hold and manage investments like Stocks, Bonds, Mutual Funds in a digital format. Just as you need to have a bank account to deposit your money and earn interest, you need to open a Demat account to buy or sell financial securities such as Stocks, Mutual Funds, Equity Traded Funds (ETFs), SGBs and more. When you buy stocks or shares, they will get credited to your account.

When you sell the stocks or shares you have purchased,

they will get debited from your account.

By opening a Demat account, you do not need to transfer your share certificates physically to the buyer. You need to link your bank account with your Demat account, through which you can easily buy and sell shares. It does not only save your time, but it also reduces the transaction cost.

Benefits of opening a Demat Account on Upstox

There are many benefits of opening a Demat Account on Upstox. Let’s look at a few of them

- Easy TrackingDemat accounts make it easier to track & monitor your investments online

- Reduces RisksNo risk of theft, forgery or misplacing your investments

- Saves TimeLesser time to buy and sell investments online instead of physical transactions

- Saves TimeLesser time to buy and sell investments online instead of physical transactions

Documents Required To Open A Demat Account

Opening a Demat Account requires just 2 documents: PAN + Aadhaar

- If you already have a Demat account with another broker: No need to reupload these documents, they will be fetched automatically from the central KYC agency.

- If you do not have a Demat account with another broker: These documents will be fetched from DigiLocker. For this, Aadhaar needs to be linked with a mobile number.

- Want your Demat account for Futures, Options, Currencies and Commodities?Keep these handy: Salary Slips, Bank Statement or ITR etc.

- Want your Demat account for Futures, Options, Currencies and Commodities?Keep these handy: Salary Slips, Bank Statement or ITR etc.

Charges to Open A Demat Account

Account Opening: There are no charges to open an Upstox Demat account

Account Maintenance Charges: While some brokerages may charge an annual account maintenance charge, there are no annual account maintenance charges at Upstox, you can open and use your Upstox Demat account for free.

Commission: There is zero commission when you invest in Mutual Funds or IPOs.

Brokerage Charges: Up to ₹20 on Equity, Futures, Options, Commodity and currency orders.

By opening a Demat account, you do not need to transfer your share certificates physically to the buyer. You need to link your bank account with your Demat account, through which you can easily buy and sell shares. It does not only save your time, but

By opening a Demat account, you do not need to transfer your share certificates physically to the buyer. You need to link your bank account with your Demat account, through which you can easily buy and sell shares. It does not only save your time, but it also reduces the transaction cost.

Demat Account vs a Trading Account

| Trading | Demat |

|---|---|

| Stores the cash used to buy shares. Any profit and losses from trading reflected here. | Stores the bought shares, bonds, government securities, and Mutual Funds in electronic format |

| Opened via a stockbroker | Opened via a depository participant - CDSL or NSDL |

| Facilitates trading related transactions | Ensures the safety of shares |

Safeguarding Your Demat Account

Your Demat Account holds all your investments and wealth, so safeguarding it is pretty important. Here are a few pointers to ensure your Demat Account is secure and safe:

- Add a Nominee to your Demat AccountA nominee is the person you legally appoint to own your shares in your absence.

- You can add a Nominee by following these stepsHow can I add a new nominee to my account?

- Keep your account details confidentialNever share your Upstox Demat and Trading account passwords/PINs with anyone

- Keep your account details confidentialNever share your Upstox Demat and Trading account passwords/PINs with anyone Update your Upstox App Regularly update your Upstox app for the latest security patches and bug fixes Beware of phishing attempts!Beware of phishing. Upstox will never ask for passwords/ sensitive details via email/messages. Avoid suspicious links and downloadsDon't click on suspicious links or download attachments from unknown sources Secure your devicesProtect your mobiles/computers with a strong passcode/ biometric authentication for added protection Beware of public Wi-FiAvoid using open public Wi-Fi networks when accessing your Upstox app Monitor your account activityIf you observe any suspicious activity, report to Upstox immediately

What is a Demat Account Number?

The Demat Account Number is a 16-digit number. Eg: 12081800 00123456. The first 8-digits of this number are the DP ID and the last 8-digits are the Client ID. You'll also get your DP ID when your account is opened with Upstox.

How to check my Demat Account Number?

Here are steps to check your Demat account number on Upstox:

- Step 1: Login to the Upstox app using your 6-digit PIN or Biometrics.

- Step 2: Click on ‘Account’ at the bottom of the screen.

- Step 3: Click on ‘My Account’.

- Step 4: Click on ‘Profile’.

- Step 5: Click ‘My trading plan’ under ‘Profile’. You will be redirected to the ‘Trading Plan’ page.

- Step 5: Click ‘My trading plan’ under ‘Profile’. You will be redirected to the ‘Trading Plan’ page.

- Step 6: Here, you will find the 16 digit Demat account number and your plan details.

Linking Another Demat Account On Upstox

If you wish to transfer shares from your other CDSL/NSDL Demat Account to Upstox Demat Account, you will need to submit a DIS (delivery instruction slip) to your existing broker. It must be duly filled out and signed by all account holders. Details to be furnished in the Delivery Instruction Slip (DIS):

- Depository: CDSL

- DP Name: Upstox Securities Pvt. Ltd

- Demat Id: ______________ (12081800 / 12081801)

- Demat Account number (8 digit number): ___________

- Client/Beneficiary ID (16 digit number): _____________ (Combination of Demat ID and Demat Account number) Security details: Scrip name, ISIN, and Quantity. In case your Broker asks for a Client Master Report (CMR) refer to the below link what-is-cmr-and-how-to-request-for-a-cmr- Note: Transfer of shares takes a minimum of 24 hours to be completed.

What are the Demat and Remat charges?

Demat stands for dematerialization. Dematerialization as the name suggests is the process through which a trader or investor can convert existing physical share certificates into electronic shares. For Dematerialisation, the charges are ₹ 20/- per certificate and an additional charge of ₹ 50/- per request.

Remat stands for rematerialization. Rematerialization is the process through which you, the trader, can get your electronically held securities converted into physical certificates by processing your request via Upstox. The Remat charges are ₹25 for every 100 shares or part thereof. Remat charges are subject to a maximum fee of ₹5,00,000 or a flat fee of ₹25 per certificate, whichever is higher.

Remat stands for rematerialization. Rematerialization is the process through which you, the trader, can get your electronically held securities converted into physical certificates by processing your request via Upstox. The Remat charges are ₹25 for every 100 shares or part thereof. Remat charges are subject to a maximum fee of ₹5,00,000 or a flat fee of ₹25 per certificate, whichever is higher.

Frequently asked questions

What is a Demat account? And what is the full form of Demat Account?

The full form of Demat Account is ‘Dematerialized Account. It's like a digital wallet for your stocks and investments.

Why should I have a Demat account?

Can I have two Demat accounts?

Do I have to pay for using the platforms?

What is the brokerage cost of trading in Futures and Options?

What is the brokerage cost of trading in Equities?

Do you offer margin against shares?

Trading with Margin Pledge on Upstox come with the following benefits:

- Enjoy up to 90% collateral margin against 1400+ stocks

- Get a 100% margin against ETFs and SGBs. No need to maintain 50:50 cash to collateral ratio

- Never miss another trading opportunity due to lack of funds

- Enjoy low cost pledging starting at just ₹20/order with no paperwork

- No need to use own capital to take new trading positions

What are your square-off charges?

What are your Call & Trade charges?

What are BTST orders?

What are your charges for Offers For Sales (OFS orders) and buyback orders?

How can I open a Demat account online?

- Enter essential details - mobile number, email address, PAN and other personal details

- Verify your identity by taking a live photo.

- Verify bank account details

- (Optional): Add a nominee to your account

- eSign and done!

We will now verify your application and update you on the status within 48 hours.

Here’s the eligibility criteria to open an Upstox Demat account

- You need to be over 18 years

- You have to be a resident of India

- Your PAN should be linked to Aadhaar

Which Demat account is best in India?

- Transparent pricing: No extra charges, making your investments clearer

- Easy transactions: No need to visit offices, you can just click to buy or sell shares

- Faster payments: With fast and seamless payment gateways, you can trade more efficiently on Upstox

- Convenience: Upstox’s Demat account makes investing in stocks simpler

- Free access: Unlike many brokerage firms, Upstox offers a free Demat account. Hence no hidden fees

Is Upstox a free Demat account?

What are the charges for opening a Demat account online?

Can we have multiple Demat trading accounts?

How to check Demat account balance?

What are the AMC charges in Upstox?

- AMC charges refer to Annual Maintenance Charges

- These are fees that some financial service providers may impose to cover the cost of maintaining and servicing your account on a yearly basis

- AMC charges can vary depending on the type of account or service you have with the provider

- It's essential to be aware of any AMC charges associated with your account to make informed financial decisions.

What is the difference between Demat & Trading accounts?

- Holds various investments like stocks and ETFs

- Eliminates the need for physical certificates

- Simplifies tracking and managing assets in a digital format

- Facilitates buying and selling of stocks in the share market

- Acts as a gateway to actively participate in stock trading

- Provides a platform for executing transactions and managing portfolio movements in real-time

- Enables you to make strategic decisions and engage in the dynamic world of stock trading

Which is the best app to open a Demat account?

How to apply for a Demat account?

- Choose a brokerage firm like Upstox

- Visit their website or app

- Fill out the application form with required documents to open a Demat account

What are the Demat account charges in Upstox?

Can an NRI Open Demat Account?

- To get started, NRIs must have either a PIS NRO (Portfolio Investment Scheme Non-Resident Ordinary) or a PIS NRE (Portfolio Investment Scheme Non-Resident External) account.

- Here's a breakdown of these accounts:

- NRE Account (Non-Residential External): This account is designed to hold foreign income, and the funds in it are fully repatriable. This means you can freely transfer money back to your home country.

- NRO Account (Non-Residential Ordinary): On the other hand, an NRO account is meant for holding Indian income. The funds in this account are non-repatriable, meaning you can't easily take the money abroad.

- In addition to an NRE or NRO account, NRIs looking to invest in the Indian stock market through a Demat account must also obtain permission from the RBI (Reserve Bank of India) through one of our partner banks, such as HDFC or Axis Bank. This process falls under the Portfolio Investment Scheme (PIS).

- With a PIS account, NRIs have the flexibility to use funds from both their NRO (non-repatriable) and NRE (repatriable) bank accounts for making investments in India.

How to transfer shares from one Demat account to another online?

Offline via a Delivery Instruction Slip (DIS) included in the Demat account's welcome kit

- Fill in the DIS with details like BO ID, ISIN, DP Name, and Depository

- Choose 'Off Market' if transferring within the same Depository

- Submit the filled DIS to the current broker

- The broker verifies and sends it to the Depository

- Depository transfers shares to the new broker

- Some fees may apply, but closing a Demat account is free with an unused DIS

Online Share Transfer via NSDL or CDSL

- Register on NSDL or CDSL platforms

- Select 'EASIEST' (Electronic Access to Securities Information and Execution of Secured Transactions)

- Fill and print the form, submit it to the Depository Participant (DP)

- DP verifies and forwards details to the Depository

- Depository confirms via email

- SomLogin to NSDL or CDSL to transfer shares independently

- Transfer typically takes 3-5 working days

What are the types of Demat accounts?

Regular Demat account: This is the standard type of Demat account suitable for individual investors. It holds various financial instruments like Stocks, Bonds, And Mutual Funds.

Repatriable Demat account: This account is for Non-Residential Indians (NRIs) who want to invest in the Indian stock market using foreign funds. Investments and earnings in this account can be repatriated (transferred) back to the NRI's foreign bank account.

Non-Repatriable Demat account: Similar to the Repatriable account, this is also for NRIs. However, investments and earnings in this account cannot be repatriated.They must remain in India.

How to add a nominee in a Demat account on Upstox?

A nominee is the person or person(s) you legally appoint to own your shares in your absence.

- Adding a nominee can provide peace of mind knowing that your loved ones will be taken care of in case of an unfortunate event

- It can help avoid potential disputes among your heirs about who should inherit your assets

- Saves your loved ones from having to go through tedious paperwork to access your assets in case of your death

Steps to add a nominee to your Upstox Demat+Trading account:

- Log in using your 6-digit PIN or Biometrics

- Click on 'Account' and then 'Profile'

- Click 'My nominees' under 'Profile'

- You will be redirected to the 'Nominee details' page, where you will click on 'Add nominee' or 'Opt-out'

- Fill in the nominee details and then click on 'Continue'

- Upload an ID proof of the nominee

- Once the documents are uploaded, enter the 'Nominee share in %' you want to give to that nominee You also have the option to add up to 3 nominees to your account

- 'eSign with Aadhaar OTP

How to close a Demat account online?

- Basic closure: This is for accounts with no holdings, pending payments, or charges. It's a simple online process, often resulting in a quick response.

- Transfer & closure: If your account has funds, securities, or charges, this process can be more complex.

Here are the steps to close a basic Demat account with no holdings:

- Download the closure forms from your broker's website

- Carefully read and follow the instructions in the form

- Attach necessary KYC documents and provide account details

- Ensure the information matches across all documents

- State the reason for closing the account

- If there are multiple owners of the account, all must sign the closure document

To know these steps in detail

What is Dematerialization?

- Physical share certificates are surrendered to a depository participant (DP), typically a bank or financial institution

- The DP verifies the certificates and updates the investor's Demat account electronically

- The investor is then provided with a statement of holdings, much like a bank statement. This reflects their digital holdings in electronic form

Dematerialization eliminates the need for physical share certificates and offers several advantages, including:

- Easy and secure access to holdings

- Reduced risk of loss or damage

- Streamlined trading and investment processes

It is a fundamental aspect of modern stock market and investment practices.

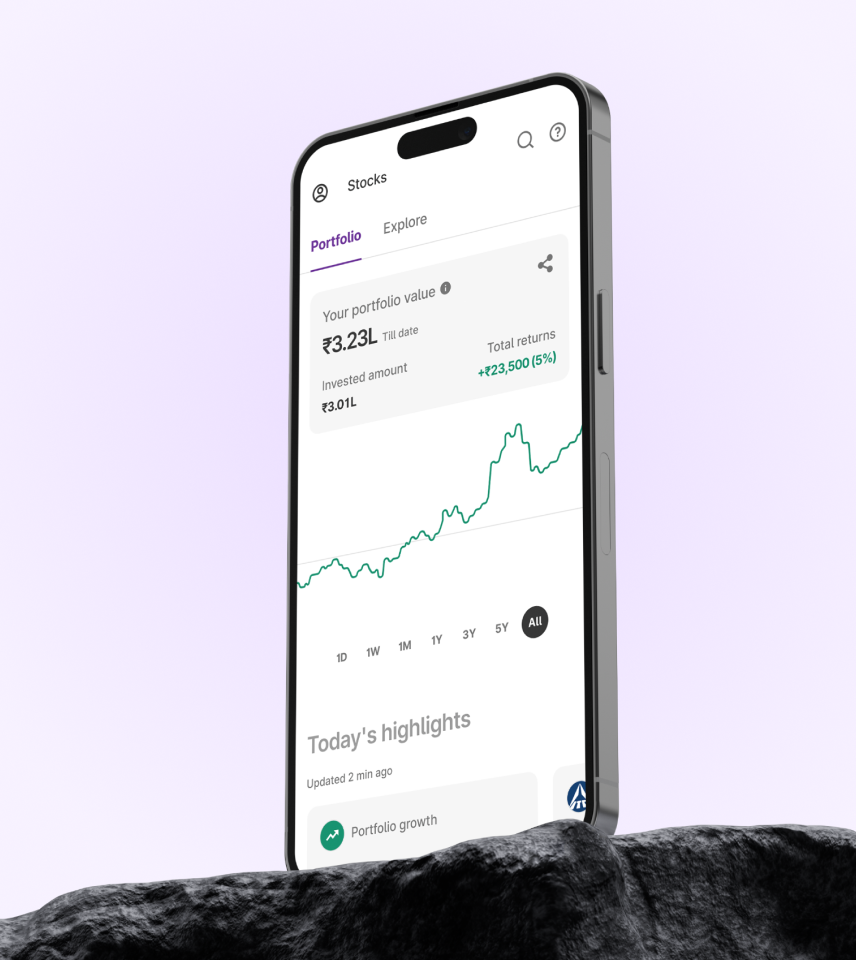

2X Margin on 450+ stocks

2X Margin on 450+ stocks Investment ideas on the app

Investment ideas on the app Analyst ratings

Analyst ratings SIP and Mutual Funds

SIP and Mutual Funds