Overview

Whether you are a new trader or an experienced one, you would agree that making a loss is one of the most painful parts of trading. The situation becomes worse if the losses are oversized or if one is making consistent losses. While it is not possible to completely avoid losses, here are some best practices to manage them.

1. Plan your trade

Every trade is important. And it requires careful planning. A trading plan could be as simple as the one below where you have defined the:

- Entry price

- Exit price when trade is in profit

- Exit price when trade is in loss (a.k.a. stop-loss)

A trading plan that is prepared by considering both profit and loss scenarios has a twofold advantage. One- it helps alleviate your anxiety. Two- it prepares you to handle the loss, in case the trade goes wrong.

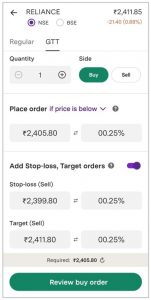

A planned trade can be placed in advance using a GTT (Good Till Triggered) order. With GTT, you can place entry, stop loss and target orders in one go. Know more about GTT here.

Example of a GTT order

2. Follow position sizing

While a lot of attention is given on ‘what to trade’, very little thought is given on ‘how much to trade’ or position sizing. Traders can follow these simple steps to decide on how to trade.

Step 1: Define your capital e.g. ₹50,000

Step 2: Define risk per trade e.g. 2%. Based on the capital above, the risk per trade is ₹1000. Based on your risk appetite the risk per trade can be increased or decreased.

Step 3: Calculate quantity using the below formula.

Quantity = Risk per trade / (Entry price - Stop loss)

Suppose, if you plan to take the below trade and you are ok to risk ₹1,000 per trade as calculated above:

- Entry price = ₹650

- Stop-loss = ₹600

Quantity can be calculated as below:

= 1000 / (650-600)

= 1000 / 50

= 20 shares

If you trade more than 20 shares, you are over-shooting your decided risk amount. Most traders falter here and over-trade.

Deciding your risk capacity per trade and accordingly, position sizing will help you stay in the game for longer innings!

3. Increase your knowledge

Learning technical analysis (a study of price charts) can go a long way in fine-tuning your trading performance. Even with a basic understanding of candlestick patterns, you could easily identify trend changes and decide on the entry and exit price levels. Similarly, studying open interest data for options not only helps gauge market direction but also helps to identify support and resistance zones.

4. Don’t expect overnight success

Just like in investing, compounding can work in trading. With every little profit added to your capital, your position size for the next trade can increase and so can your profit. Over time, it can have an exponential effect on your portfolio. In the example discussed in #2 above, the position size was 20 shares. Now for a similar trade and maintaining a 2% risk per trade formula, your position size would be 30 shares if your capital increases to ₹75,000. A higher quantity of shares would mean a bigger profit and still, you are not risking more than 2% of your capital in one trade.

5. Don’t fall into the trap of greed and fear

An objective approach to trading helps avoid falling prey to greed and fear. The biggest losses happen when a trader over-trades due to greed. Similarly, in fear, a trader may book profit early and lose out on a big opportunity. However, have a trading plan with well-defined profit taking level, stop loss level and position size helps to keep emotions at bay.

6. Don’t stretch your investments too thin

Due to initial success or losses in one market, traders tend to try their hands at multiple markets viz. equity, commodity, and currencies simultaneously. Although executing a trade in any market is similar and just a matter of a few clicks or taps, all these markets behave differently. They offer different risk and reward profiles. Furthermore, their trading hours vary. Most traders who operate independently may not have enough time and knowledge bandwidth for each market and thus may lose focus. This could lead to losses that could be easily avoided by focusing on a few things.

To conclude,

- Plan your trade

- Follow position sizing

- Increase knowledge

- Do not expect overnight success

- Do not fall into the trap of greed and fear

- Do not stretch too thin

Follow the above points to improve your trading performance. Manage your losses. Trade smart.