Upstox Originals

Sectoral twist & turns: Outperformers and underperformers in this bull market

.png)

6 min read | Updated on September 24, 2024, 14:11 IST

SUMMARY

Guess the sector that has delivered the highest outperformed in the past 5 years? Can you? Even in a bull market, sector allocation is an important decision for most investors as it can impact portfolio performance. In this article, we look at the top out and underperformers over the past 5 years. But do remember, an underperformer last year, can easily become an outperformer this year!

Sector allocation is important for a lot of investors

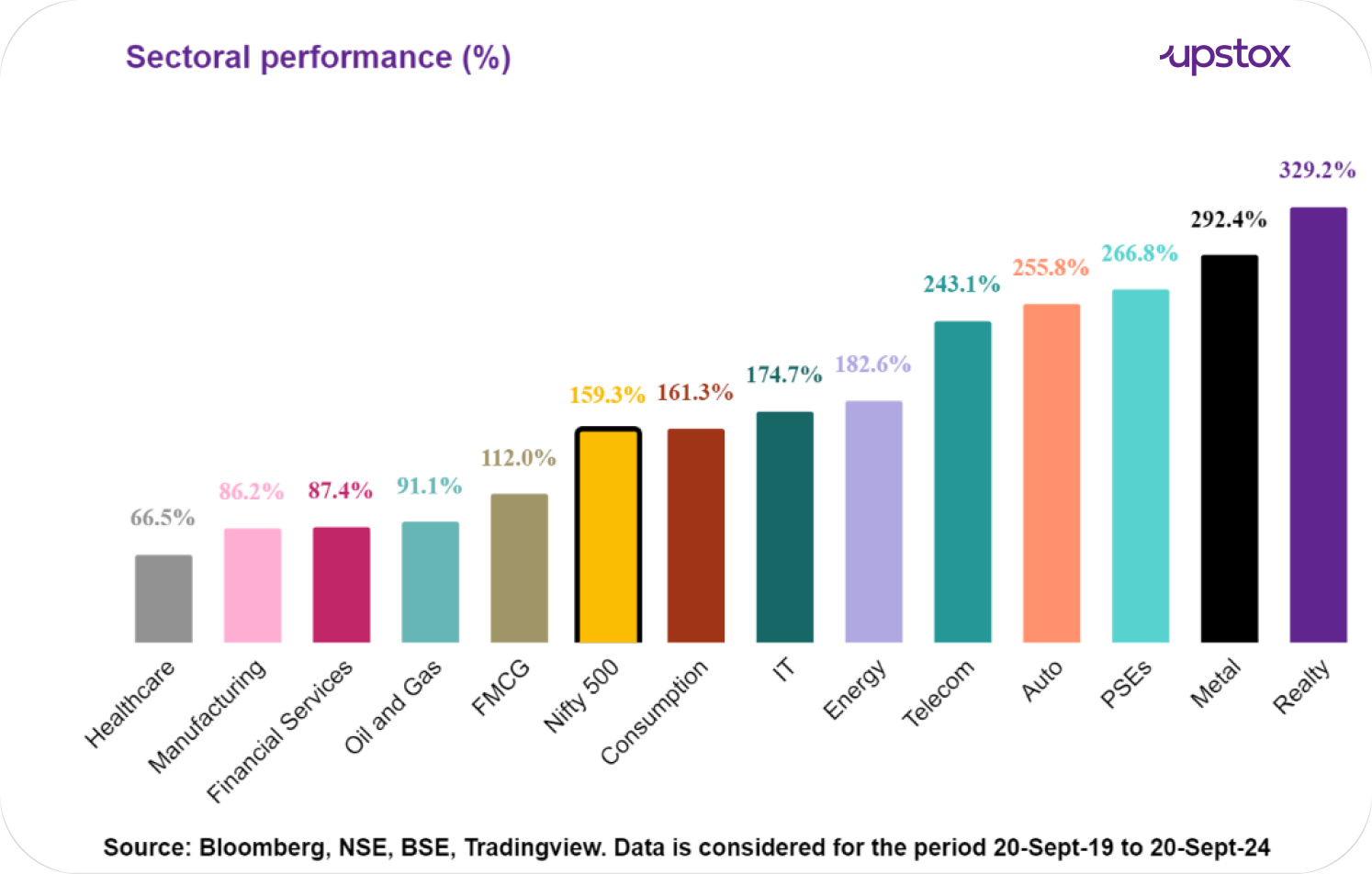

By now, it is common knowledge that Indian markets are at or near an all-time high. In the past 5 years, the markets (Nifty 500) have risen ~161.1% in absolute terms, a staggering 21.2% CAGR returns.

It has been one of the strongest bull markets in our history, with every dip being bought into.

Now, every bull market has sectors that outperform (deliver returns higher than the broad markets) and those that underperform.

If we asked you, could you guess? Name the top 3 sectors that have delivered the highest returns in the last 5 years (Sep 19-Sep 24).

No no, don’t look below, just guess first.

The answer really might surprise you!

Let’s take a look.

In the chart below we look at the absolute returns of each major sector over 20-Sept-19 to 20- Sept-24 and compare it with the Nifty500.

Why Nifty500? It is a broad-based index, with top 500 listed companies on the NSE. Sectoral indices have stocks across market caps, so we have chosen that index.

Did any of the above take you by surprise?

Let’s now take a look at some of the drivers that have led to this performance.

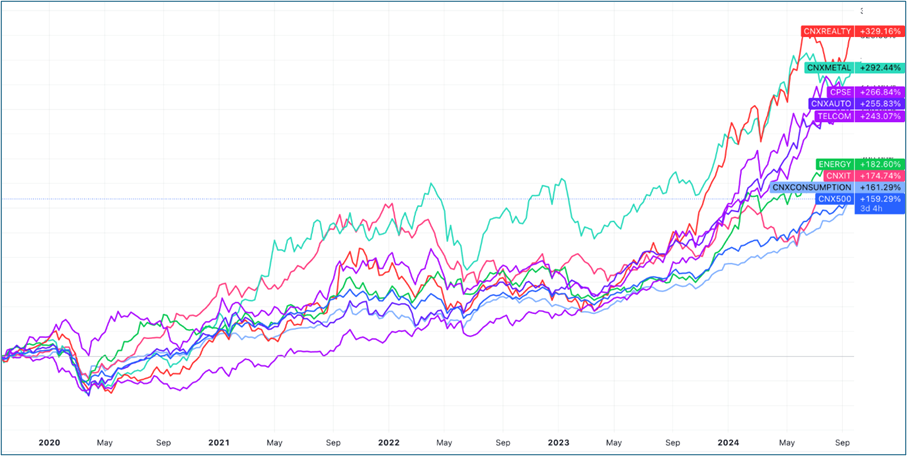

Major sectors that outperformed the Nifty 500

Source: Tradingview, NSE, BSE

Realty

- Post COVID, in 2021, it saw strong momentum due to lower interest rates and various government measures to boost this sector

- During 2022-23, challenges emerged because of rate hikes

- Since mid-2023, the sector has seen a strong resurgence driven by improved fundamentals of companies, rising luxury housing demand, lower inventory, and easier credit availability

Metals

- 2021-2022 saw metals as top performers due to increased prices from high infrastructure demand - across all segments ranging from roads to vehicles

- As can be seen from the chart above, metals have been one of the consistent outperformers. Weakness in Chinese demand was offset by an overall strong global economy

Public Sector Enterprises (PSEs)

- PSEs have benefitted from improving corporate governance, financial management, and capital allocation. All of these have led to an improved investor perception, leading to their re-rating

- Besides that, focus on sectors of a strategic nature like railways, energy, etc along with divestment proposals of a few PSUs, improved the sector’s prospects

Automobiles

- This sector was severely impacted due to challenges like the IL&FS crisis (which caused a lending shortage), increased insurance costs, and the BSVI transition. All of these led to a sharp spike in cost and hurt volumes

- Since 2022, the sector has made a resurgence due to government support through PLI and FAME

- New vehicle launches, and strong EV adoption, further strengthened the sector’s growth

Telecom

- This sector has seen a bit of a roller coaster ride these past five years, having witnessed challenges relating to tariff hikes, sharp increase in competitive intensity, to 5G capital expenditure

- Since 2023, the sector has seen a re-rating driven by the successful rollout of 5G, further tariff hikes, increased data consumption, and the introduction of a new telecom bill

Energy

- The sector has seen steady growth since 2021 due to government policies like the Green Hydrogen Mission, PLI for renewables, and a 500 GW renewable energy target

- Besides this, rising demand from industrial growth has further supported this sector

Information Technology

- This sector saw robust growth in 2020-21 from increased technology adoption due to COVID-19

- While over a 5-year period, the sector still comes out as a winner, it has seen corrections recently stemming from an overall industry slowdown, valuation concerns and massive layoffs

Consumer Discretionary

- The consumer discretionary sector in India, despite not leading in sectoral performance, has shown resilience with four out of the last five years being positive

- India's status as the world's fastest-growing and fifth-largest consumer market underpins this sector's potential

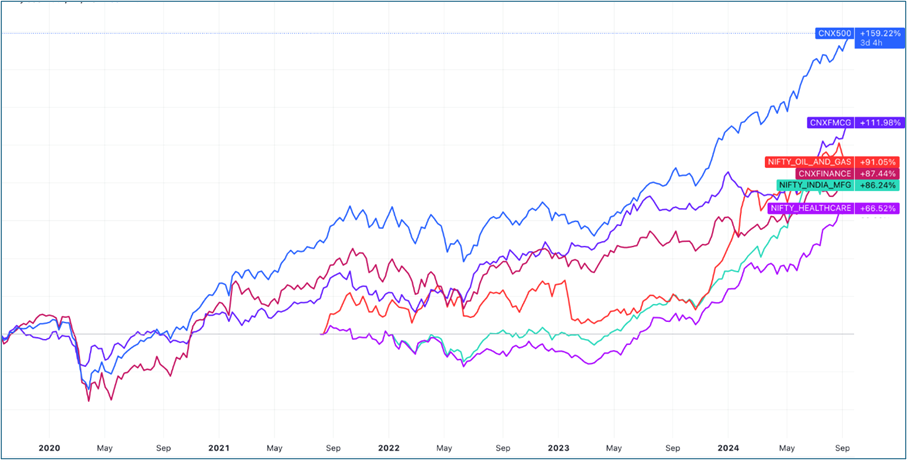

Major sectors that underperformed the Nifty 500

Source: Tradingview, NSE, BSE

Healthcare

- Saw a significant performance boost in 2020 due to global vaccination efforts, followed by subdued returns for the next couple of years as investors booked profits

- The sector has however rebounded in 2023 and 2024 fueled by more attractive valuations and government incentives like the Production Linked Incentive (PLI) scheme

Manufacturing

- 2020 was the year of underperformance as lockdown halted manufacturing activities

- While 2021-22 saw recovery backed by strong margins, demand, capex and lower inflation

- China Plus One theme and the government's favorable policies like PLI, and boost to Make in India added support to the sector

- Capital expenditure has reached a record high, signaling strong growth potential for this sector

Oil & Gas

- Suffered during the pandemic with reduced output, low demand, and adverse crude prices. Recovery in 2021-2022 was driven by rising crude prices (Russia-Ukraine conflict) and increased economic activity and an overall gas network expansion

- However, uncertainty due to global macro events has increased volatility in this sector, coupled with an increased competition from renewables

- That said, in 2024, the sector has surged ~41%

Financials

- In 2021, a rate cut intended to boost the economy conversely led to lower net interest margins for financial institutions

- Financials with robust balance sheets experienced moderate growth in 2022 and 2023

- By 2024, the sector again confronted issues like slower deposit growth, a surge in unsecured loans, elevated interest costs, and more stringent regulatory controls

FMCG

- FMCG is another defensive sector with better fundamentals. The sector did well during 2020 because of increased demand for essential items during the pandemic

- As the rising inflation hits them hard, their margins fall during 2021 to 2023. This made their valuations cheaper than historical valuations

Conclusion

Our analysis above looks at the five years from Sept 19 to Sep 24. It is encouraging to note that even healthcare’s absolute return of 66.5%, translates into a CAGR of ~11%, once again beating most other financial assets.

Overall sector performance is impacted by the performance of the underlying business, financial strength, and government schemes, among other factors. Last year’s underperformer of last year can become an outperformer of the current year and vice versa. Keeping track of the key factors impacting sector performance for investors is important.

Next Story