Market News

Market highlights| NIFTY50 remains range-bound, 50 DMA remains a hurdle

.png)

2 min read | Updated on October 10, 2024, 20:11 IST

SUMMARY

NIFTY50 index encountered resistance at its 50-day moving average (DMA) for the second consecutive session and closed flat. This level remains a critical hurdle, and the trend may continue to show weakness if the index fails to recapture the 50 DMA.

NIFTY50 remains range-bound, 50 DMA remains a hurdle

Markets traded in a narrow range and remained subdued on the weekly expiry of NIFTY50’s options contracts. The NIFTY50 index broadly traded in a range of 150 points and ended the day below tad below the 25,000 mark.

Sectorally, the Private Banks (+1.5%) and Metals (+0.4%) advanced the most, while Pharma (-2.0%) and IT (-1.2%) declined the most.

The technical structure of the NIFTY50 index formed an inside candle on the daily chart and traded within the range of 9 October. The broader trend of the index remains weak with index trading below its 20 and 50 day moving averages (DMA). The immediate support for the index is around 24,700 zone, the low of September month. On the other hand, the resistance remains at 50 DMA.

-

Top gainer and loser in NIFTY50: Kotak Mahindra Bank (+3.8%) and Cipla (-3.3%)

-

Top gainer and loser in NIFTY Midcap 100: Mazagon Dock Shipbuilders (+8.4%) and Lupin (-5.5%)

-

Top gainer and loser in NIFTY Smallcap 100: Garden Reach Shipbuilders (+6.6%) and

Key highlights of the day

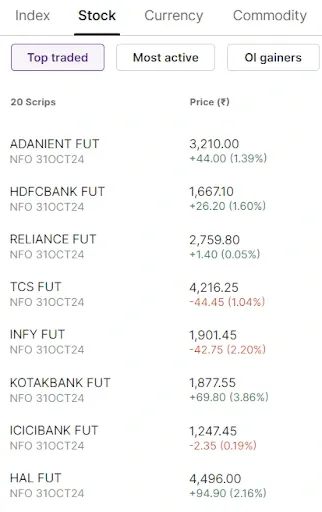

Top traded futures contracts

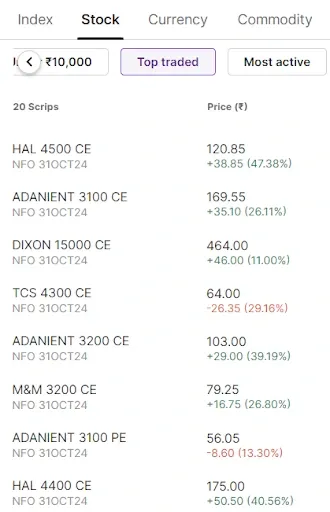

Top traded options contracts

4 trading insights from NIFTY 200🔍

📉Open=High (Bear power): PB Fintech (Policy Baazar), Coforge, Dr. Reddy’s, Delhivery and Zydus Lifesciences

📈Open=Low (Bull power): Tata Elxsi, Indraprastha Gas, Tata Technologies, Indus Towers and UPL

🏗️Fresh 52 week-high: CG Power, Dixon Technologies, Polycab, Page Industries and HCL Technologies

⚠️Fresh 52-week-low: N/A

See you tomorrow!

Related News

About The Author

Next Story