Market News

Bajaj Finance Q2 results: Net profit likely to see double-digit growth driven by robust loan demand and higher AUM

.png)

4 min read | Updated on November 10, 2025, 11:03 IST

SUMMARY

Bajaj Finance is set to announce its September quarter (Q2FY26) results on 10 November. The company is expected to post a 23–24% YoY rise in net interest income (NII). Strong loan growth and a rise in AUM to ₹4.62 lakh crore are likely to support earnings momentum.

Stock list

Bajaj Finance options trend indicates implied movement of ±5.2% for 25 November expiry contract

Leading non-banking financial company (NBFC) Bajaj Finance will announce its results for the September quarter (Q2FY26) on 10 November 2025. The results will be announced after the market hours.

According to experts, Bajaj Finance is expected to report robust growth in net interest income (NII) and net profit for the September quarter, driven by a double-digit increase in its loan portfolio and assets under management (AUM).

Bajaj Finance’s NII is expected to be in the range of ₹10,930–₹10,970 crore, representing a year-on-year (YoY) increase of 23–24%. The company reported an NII of ₹8,838 crore in the same quarter last year. Meanwhile, net profit could rise by 17–20% YoY to a range of ₹4,750–₹4,830 crore. In Q2 FY25, Bajaj Finance reported net profits of ₹4,014 crore and ₹4,765 crore in the previous quarter.

During its quarterly business update, Bajaj Finance reported a 26% year-on-year (YoY) growth in new loans booked, reaching 1.21 crore. Meanwhile, its total assets under management grew by 24% YoY to ₹4.62 lakh crore. As of 30 September 2025, the total customer franchise stood at 11.06 crore.

Investors will be keen to hear management's commentary on the outlook for loan growth, net interest margin and gross and net non-performing assets (NPAs) when the Q2 results are announced.

Ahead of the results, Bajaj Finance shares ended the day at ₹1,066, up 1.2%. So far this year, Bajaj Finance shares have delivered a return of over 56% to investors.

Technical view

Bajaj Finance has extended its uptrend, closing the latest week at ₹1,066, which is 2.2% higher than the previous week. This indicates continued buying momentum after a brief consolidation period. It is trading well above its 21-week (₹975) and 50-week (₹900) exponential moving averages (EMAs), suggesting a bullish trend.

A breakout above the ₹966–₹979 zone, which previously acted as a key resistance level, has turned it into an important support area. Unless this zone is breached on the closing basis, the trend may remain bullish. A break below ₹966 zone could trigger a pullback towards the 50-week EMA.

Options outlook

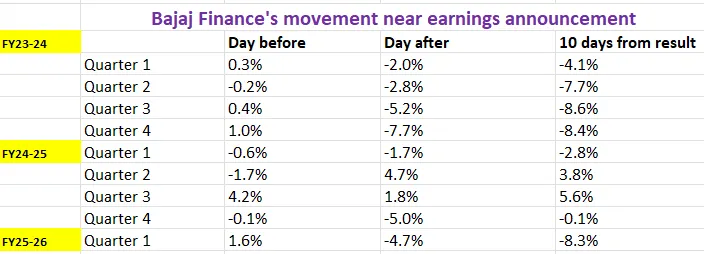

Let’s examine how Bajaj Finance stock has reacted to its quarterly earnings announcements over the past nine quarters to gain insights into its price movements.

Options strategy for Bajaj Finance

Ahead of the 25 November expiry, the implied movement from the options market is ±5.2%. Traders can therefore consider the Long and Short Straddle strategies to take advantage of the anticipated volatility and price swings.

About The Author

Next Story