Introduction

PB Fintech Limited, the parent company of Policybazaar and Paisabazaar, is all set to launch its IPO on 1 November. Here’s everything you need to know about the IPO:

Company overview

PB Fintech operates two online platforms for insurance and lending products. In 2008, it launched Policybazaar, a digital insurance marketplace, intending to create awareness about the financial impact of death, disease, and damage. Policybazaar is an insurance aggregator designed to compare insurance policies offered by various insurers and buy insurance policies online. In FY20, it was India’s largest digital insurance marketplace with 93.4% share in terms of the number of policies sold.

Similarly, Paisabazaar is also a big player in the digital lending space. Launched In 2014, it was India’s largest digital retail credit online marketplace with 51% market share in FY20. Paisabazaar is a digital lending platform that allows customers to compare, choose and apply for credit products such as personal loans, business loans, and credit cards.

Offer details

- IPO size: ₹5,710 crore

- Fresh issue: ₹3,750 crore

- Offer for sale: ₹1,960 crore

- Price Band: ₹940-₹980 per share

- Lot size: 15 shares

- Cost per lot: ₹14,700

- Issue opens: 1 Nov 2021

- Issue closes: 3 Nov 2021

- Basis of allotment date: 10 Nov 2021

- Initiation of refunds: 11 Nov 2021

- Credit of shares to demat account: 12 Nov 2021

- Expected listing date: 15 Nov 2021

- Registrar: Link Intime India Private Ltd

- Contact: Bhasker Joshi, Telephone: +91 124 456 2907

- E-mail: investor.relations@pbfintech.com

Shares will be listed on BSE (Bombay Stock Exchange) and NSE (National Stock Exchange).

The lead managers of the stock issue are Kotak Mahindra, Morgan Stanley, Citi, ICICI Securities, HDFC Bank, IIFL Securities, and Jefferies. Link Intime is the registrar to the issue.

Reasons for going public:

PB Fintech Limited proposes to allocate the proceeds from selling shares towards the following:

- Enhancing the visibility and awareness of its brands, including Policybazaar and Paisabazaar

- Taking on new opportunities to expand its customer base including offline presence

- Funding strategic investments and acquisitions

- Replicating and adapting its business model to pursue opportunities in other regions and countries

- General business requirements

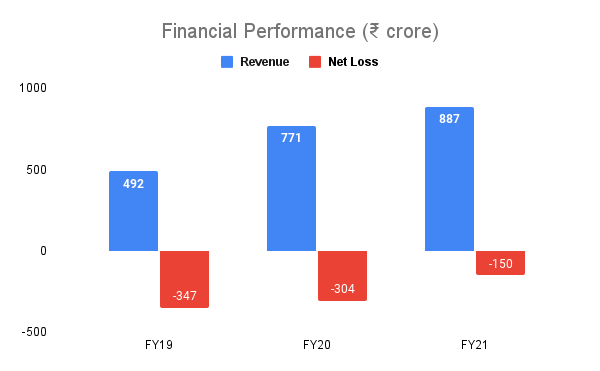

Company financials

Here’s a look at the company’s financial performance:

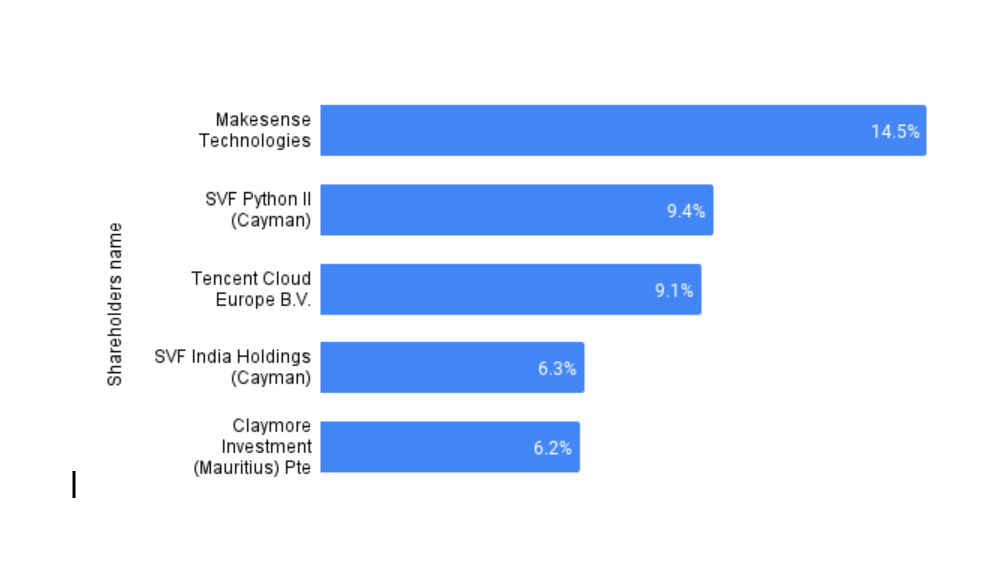

Top 5 shareholders of PB Fintech are as below:

Competitive strengths

PB Fintech has managed to set itself apart in the following ways:

- It has created strong brands such as Policybazaar and Paisabazaar.

- Offers a wide choice of financial products.

- The company caters to its customers through technology integrations with insurers and leading partners.

- The company gives its partners a low-cost platform to target the right customers

- The company does not underwrite any insurance or retain any credit risk in its books

Opportunities

- Policybazaar has already started expanding in the Middle East with operations in Dubai

- Due to the pandemic, the awareness and demand for insurance policies have increased.

Threats

- Even though PolicyBazaar and Paisa bazaar currently hold the larger market share compared to its competitors like Coverfox and BankBazaar, the business is competitive and margins are thin.

Risks

- Failure of its insurance and lending partners to meet evolving needs of customers

- Any disruption to the IT systems and infrastructure may affect its platform and service

- The company is highly dependent on insurers and lending partners. And lack of alignment or cooperation with them can lead to customer dissatisfaction.

- If confidential information is not protected, it could lead to cyber-attacks, data breaches and inappropriate use of such personal data recorded by customers.

- The company has a history of losses and estimates an increase in expenses in the future