Never miss a trading opportunity with

Margin Trading Facility

Enjoy 2X leverage on 900+ stocks

-

Never miss a trading opportunity due to lack of funds

-

Trade in top stocks with just 50% funds

-

Low cost borrowing

-

One click activation, no paperwork needed

Double your buying power with Margin Trading Facility

Let’s look at an example

-

₹ 70,000

-

upstox Pays

₹ 70,000 -

You can buy stocks worth

₹ 1,40,000

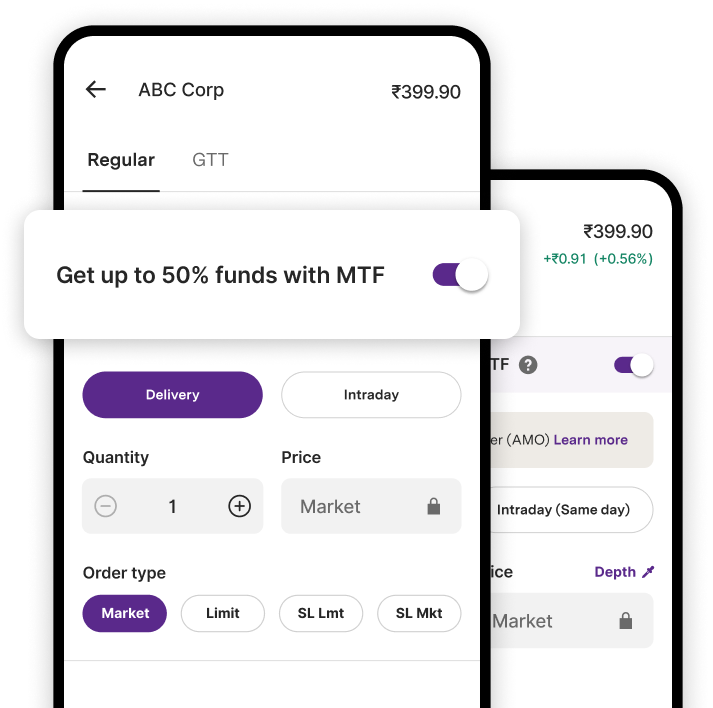

How to activate Margin Trading Facility?

It’s quick, easy and a one-time process

-

STEP

Click ‘Buy’ on any MTF applicable stock

-

STEP

Activate Margin Trading Facility from the stock details page

-

STEP

Read & accept the T&C

-

STEP

Enter your OTP and done!

All you need to know about Margin Trading Facility

Limits & Charge

- MTF is applicable on these 950 stocks

- Buy stocks worth ₹50,00,000 by borrowing up to ₹25,00,000

- Interest of ₹20/day for every slab of ₹40,000 borrowed

- One-time pledging and un-pledging charges of ₹20/stock. To know more click here

Keep in Mind

- MTF lets you borrow 50% funds to buy stocks for a limited period of 365 days only

- Gains or losses on stocks bought via MTF could be two times than a normal order

- As per regulatory guidelines, it is mandatory to pledge MTF Positions on the CDSL website by 7 PM on the same day

Frequently Asked Questions

Do I need to activate MTF every time I am using it?

No. Activating MTF is a one-time, easy and quick process. Once activated, you can use it whenever you want by switching on/off the “Get up to 50% funds from us’’ button.

What is the applicable limit under MTF?

At any given time the total amount you can avail via MTF shouldn’t exceed ₹25,00,000.

How do I return the money borrowed for MTF?

You do not need to directly return the amount borrowed. Stocks bought with MTF appear under the Positions tab (not Holdings). So, to return the amount, all you need to do is exit your ‘positions’ within 365 days.

Where will I see my MTF Positions?

All MTF Positions will be visible under the Positions tab, labelled as MTF on the Upstox platform.

To find out more:

What is Margin Trading Facility (MTF)?

When an investor can take a higher value position with only a fraction of the total transaction value, this smaller amount is called a margin. Hence, Margin Trading Facility is when the trader increases their buying capacity of shares and securities by paying only a small amount - the margin. Hence, it is simply a leveraged position in the market. Margin can be in the form of both cash and shares as collateral. The rest of the amount is paid by the broker. A nominal interest rate is charged on this as this acts as a loan.

What are the advantages of Margin Trading Facility?

Some of the key advantages of Margin Trading Facility are:- Brokers provide the liquidity by filling the gap of funds that the investor is unable to put up himself due to the lack of sufficient cash balance. Hence, investors can look at short term price movement opportunities.

- Your shares will not lie idle in your demat account. This is a great way of utilising your existing shares by using them as collateral for leveraging MTF in the equity market.

- It helps you improve the return percentage on the capital deployed. This improvement of ROE is due to trading only in margins, hence, you are paying only 25% of the costs, which means if the price moves up 5%, your ROE gain is 20%.

- You will never have to miss out on lucrative purchasing options in equity shares as through MTF, your broker provides you with the required liquidity while you pay only a minimal amount. Hence, you can now capitalise on all your opportunities in the stock market.

- The loan that is MTF is used only to appreciate assets like equity and this creates wealth for you in the long run, hence, making the loan also a lucrative option.

How to activate your MTF account?

Activating your MTF account is very simple. This facility can be traded in through your existing trading account. Simply sign the MTF agreement and transfer the initial amount requirement by way of cash or collateral, so you can start purchasing shares through this facility. An equity & demat account is a necessity. Read through the agreement as you need to understand the terms and conditions attached to MTF before you avail it, to make sure you understand how it works. You can simply do all of this through your Upstox account.How does Margin Trading Facility work?

Margin Trading Facility is a special privilege investment tool available in the market that is offered to investors of shares and securities wherein they can buy shares worth more than their purchasing capital. How it works is, the investor puts in only a fraction of the amount required. This is called Margin. This can be paid in both cash as well as using the existing bought shares in the demat account as collateral. The rest of the amount required is put in by the broker. For example, let us say you have Rs. 1 Lakh. Based on this amount, the broker may let you borrow from him, through MTF an amount of Rs. 2 Lakhs. Hence, you can now buy shares worth Rs. 3 Lakhs. You will have to pay a nominal interest rate on the Rs. 2 Lakh borrowed by you, but you can gain huge advantages in the market as the returns you earn on this amount is higher than what you may earn on Rs. 1 Lakh. All of this is done under the SEBI regulations for the same.What are the risks involved in Margin Trading Facility?

Some of the risks involved are:- Magnified Losses: Just like the margin amount lets investors magnify the profits, in the case of losses, the losses are also magnified. You may end up losing more than you have invested as the loss calculated will be on the total amount put into buying the shares, which includes your minimum amount plus the amount offered to you by your broker. While borrowing from brokers may be simple, the binding of the borrowed amount is the same as banks.

- Minimum Margin Balance: A minimum balance has to be maintained continuously in your trading account at all times. If, due to any reason, this amount falls below the required amount, you will be forced to sell some or all of the assets and securities to maintain the amount. It is a binding amount.

- Liquidation: You must follow through the terms and conditions of the agreement signed by you for availing the MTF. Brokers have the right to initiate action against you if you fail to do so. If you fail to meet the minimum margin call, brokers can liquidate your assets to recover the sum.

What is MTF pledge?

One of the most important steps in availing an MTF is completing the pledge request. It is a mandatory process that was introduced by SEBI. Upon buying shares under Margin Trading Facility, you have to pledge all the shares you want to buy to continue to hold the position. This has to compulsorily be done before 9 PM on the same day as availing it. In the case you fail to authorise your pledge, the shares are squared off on the T + 7 day. To pledge, avail and sign the agreement through your trading account. An email / SMS confirmation will be sent to you along with a link that will redirect you to the CDSL website. Enter your PAN / Demat account details here and select the stocks you want to pledge. AN OTP will be sent to you which will help you complete the process.What are the easy steps to avail Margin Trading Facility (MTF)?

To avail this facility, here are some easy steps:- Step 1: Log on to your Upstox account.

- Step 2: Select the stock that you want to purchase.

- Step 3: Enter the quantity, select product type as margin and click confirm buy.

- Step 4: Authorise your MTF pledge request by 9 PM on the same day.

- Step 5: Once it is approved, check your email / SMS for all communication. Click on the CDSL link you receive and enter your PAN / Demat account details and that’s it! An OTP will be sent to you to complete the process.

How can Margin Trading Facility benefit investors?

Margin Trading Facility can benefit investors by:- It is beneficial for those looking for price movement in the short term but do not have the sufficient cash balance.

- It makes further use of the securities available in your portfolio / demat account by using them as collateral.

- It improves the return percentage.

- It enhances the buying power of the investors.

- It is regulated by SEBI.

What are the Do’s and Don’ts while trading in MTF?

Some Do’s and Don’ts of trading in MTF are:- You can purchase and pledge only approved shares and securities in the equity market listed only on NSE.

- The product code you need to use is “MTF” while placing the order for the approved securities using .exe or mobile apps.

- In the case that you are purchasing unapproved shares or stock, use the product code “CNC” while placing the order.

- All your excess balance in your trading account will not be transferred to your MTF account unless you request it through email. But in the case of a shortfall of the margin amount, the broker holds the right to transfer the required funds from your normal account to your MTF account without providing you with any notice of the same.

- An interest rate of 11.99% p.a. Is charged on the borrowed fund value adjusting the cash amount if any. If only shares & securities have been used as collateral, the interest is calculated on a daily basis and charged on a monthly basis, at the end of the month.