Demat Account Charges In India 2023

Investing and trading have proven themselves to be extremely popular, super reliable methods to generate wealth and financial security. But of course, there are no free lunches in this world! Setting yourself up to trade and invest in securities comes at some cost, and these costs are passed on to the customers by brokerages and other service firms.

Key Points

- Opening a demat account or a trading account comes at a price. It is important that you ensure you find a service provider who suits your needs and budget.

- There are five types of account opening charges for a demat account: Demat account opening, account maintenance, custodian fees, transaction fees, dematerialization fees.

- Traditional or full-service brokers usually have more overhead costs as compared to discount brokers. That’s why the account opening charges might also vary depending on the type of broker you choose.

It’s important, in such scenarios, to have a crystal clear idea of the basic requirements, and your costs before plunging into investments and trading.

Get a detailed understanding of What is a demat account? and What is a trading account?

Demat account charges

You’re likely to run into plenty of fees and charges when you start investing in the stock market. Some of these charges are levied during your transactions, while others are generally charged on an annual basis. These charges vary from one broker to another. So choosing your broker is a very important decision!

There are mainly 5 types of charges that are levied on the account holder:

-

Demat account opening charges

These charges are what your broker will levy to set-up your dematerialized account. When the broker happens to be an existing banking institution, this account is usually free of cost. This is because the banking institute that offers broking services is doing it for a reason. The bank intends to generate more revenue by charging higher transaction fees, making this a fairly common business tactic. That’s why you should ideally check the account opening charges in light of all other bank-related fees before you begin.

- Annual Maintenance fee

This charge is levied on an annual basis, to be paid in advance to keep your account working and providing you services regularly as per your demand. The fee usually varies between 300-800 INR but isn’t necessarily directly proportional to the quality of service. This is best reflected in Upstox’s charges, which are significantly lower than all other brokers. - Custodian fee

The custodian fee is charged by the brokerage firm for the safe-keeping of your securities. This is generally charged yearly, based on the number of assets held onto by the firm. It may vary (Rs. 0.5-1) per ISIN (no. of securities) in a month. - Transaction fee

A brokerage firm will usually levy a charge on each trade. Typically, these charges vary based on the number of stocks involved and the value of the trade. Charges from depositories like CDSL are also passed on, although many brokers add their own significantly higher margins to this fee. A transaction fee would be payable by you depending on the scheme and broker you choose. - Dematerialization fee

If you hold onto some securities in the physical form, the firm would charge a nominal fee to convert these physical securities into demat form. This charge is only applicable if you wish to convert your physical securities into demat form.

Trading account charges

A trading account also has some costs associated with it. These charges are based on the number of transactions done through the account. These charges vary from one firm to another.

There are mainly 3 types of trading account charges:

- Trading Account Opening Charges

A trading account is usually free of cost when the firm is a banking institution, for reasons mentioned earlier in this article. - Annual Maintenance fee

This charge is primarily levied in advance on a yearly basis to keep your account working and ensure consistent service delivery. Many broker firms seek to simplify this process by clubbing it with account opening fees. - Transaction fee

Any brokerage firm usually charges based on the number of transactions - either based on value or on the number of stocks. As the numbers go up, so does the transaction fee. A brokerage fee would be payable by you which depends on the scheme and broker you chose.

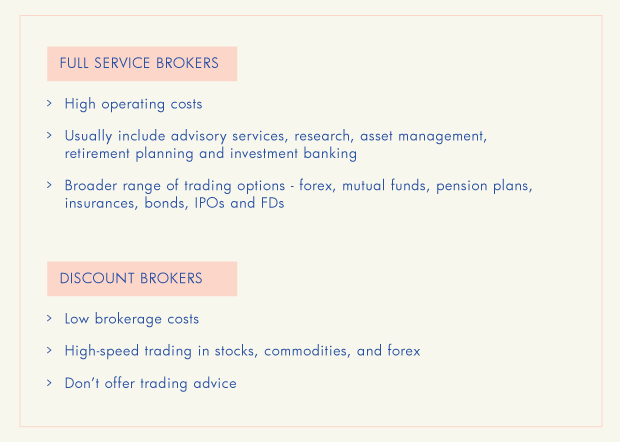

The difference between traditional and discount brokers

You’re likely to come across two different kinds of brokerage firms when you decide to start investing in the stock market - the traditional brokers and the discount brokers.

discount brokers" width="620" height="442" />

discount brokers" width="620" height="442" />

Full-Service / Traditional brokers

Full-service brokers, or traditional brokers, provide a bunch of add-on services apart from offering you the ability to trade on all sorts of securities (stocks, commodities, and currency). These usually include advisory services, research, asset management, retirement planning and investment banking. They also allow for a broader range of trading options - such as forex, mutual funds, pension plans, insurances, bonds, IPOs and FDs. Since you are getting personalized services, they come with significantly high operating costs. This could eat up a decent chunk out of your profits in the long run.

Discount brokers

Discount brokers, also known as budget brokers - are rapidly gaining in popularity. While they offer significantly lower brokerage rates, high-speed trading in stocks, commodities, and forex. These brokers won't offer you trading advice, so if you believe in your decisions and research, a discount broker is an obviously better choice. Budget brokers are ideal for a fast-paced trader who wants to place orders in a timely manner. Apart from being affordable budget brokers also offer strong and latest trading platforms that make your trading life easier.

Clearly, both these accounts are essential for everyone looking to trade and invest in securities. Now, with the new-age Aadhaar based online registrations, opening an account is easier (and cheaper) than ever.

Wrapping Up

- Depository participants such as stockbrokers are considered to be service providers in the finance world. That’s why opening a demat and/or trading account costs some money.

- Various types of brokers have their own account opening process. If the process is short and simple, the account opening fees will also be low.

- Charges such as transaction fees and custodian charges also vary depending on the type of broker you choose and the kinds of peripheral services that they provide such as investment advice and stock tips.

- After learning about different types of account charges, you as a trader or investor can identify your trading style and pattern in order to determine which type of account and service provider suits you the best!